February 23, 2021

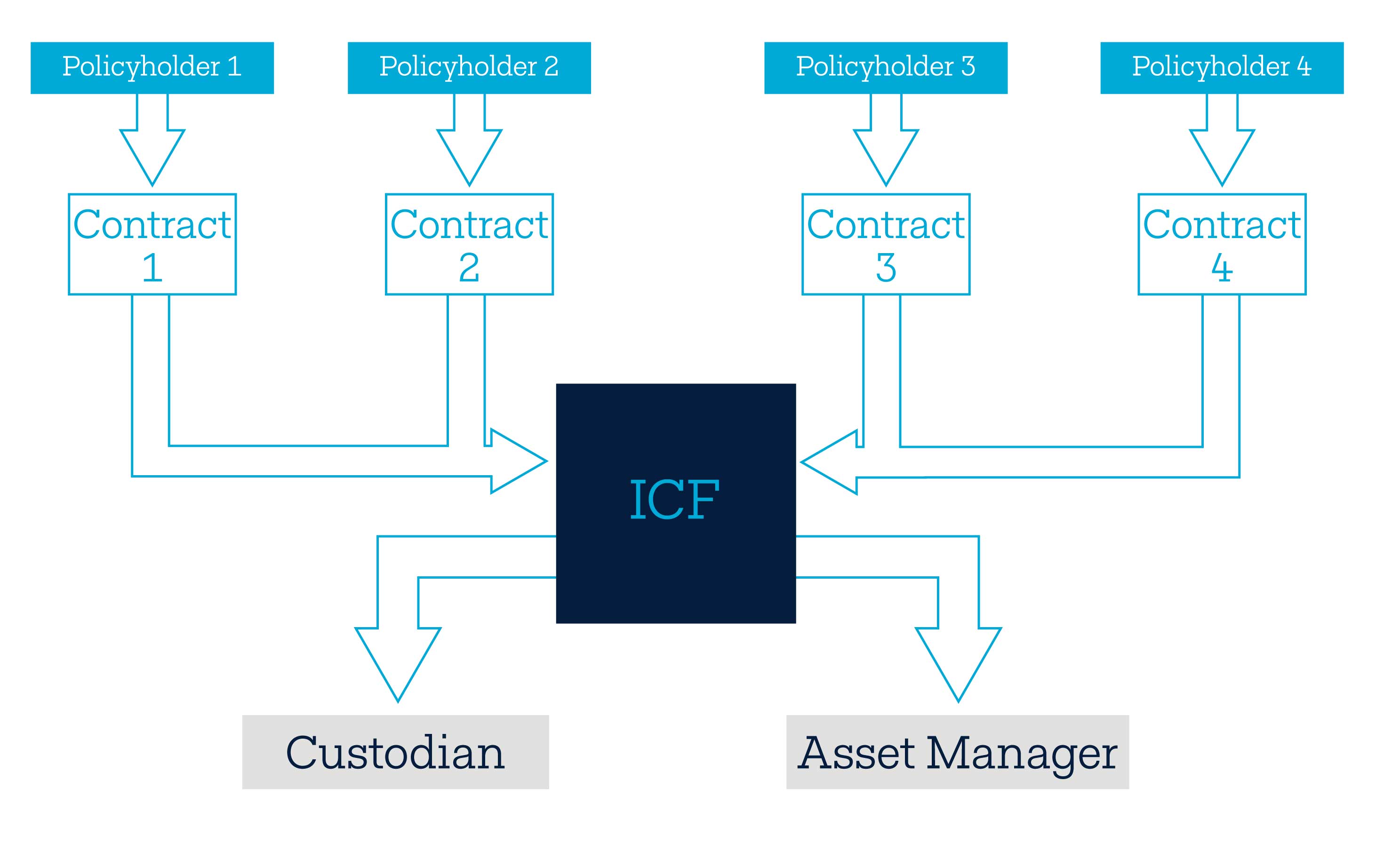

Luxembourg life assurance policies offer a wide range of solutions to wealthy clients seeking to customise and diversify their investments. Among the vehicles available under the Luxembourg regulatory framework, the Internal Collective Fund (FIC, Fonds Interne Collectif) is a fund offered by an insurance company to all its clients under a pooled management approach.

An ICF can be created much faster than a traditional UCITs (Undertaking for Collective Investment in Transferable Securities). Subject to approval from the Commissariat aux Assurances, the Luxembourg regulator, the FIC is only accessible through an assurance policy. With a minimum initial premium lower than an Internal Dedicated Fund (IDF) due to pooled management, the ICF offers easy access to innovative investment opportunities and a wide range of underlying assets, in line with the subscriber’s profile.

One ICF, one manager

The ICF’s success is based on qualitative partnerships with asset managers offering effective solutions tailored to the specific needs of investors.

The insurance company therefore selects high-quality managers who meet defined criteria in order to jointly determine the fund’s investment policy.

Investment universe

Each ICF has an investment profile and investment objectives clearly defined in accordance with investors’ needs and the specific features of the market. Accordingly, the investment strategy and assets are rigorously aligned with market opportunities and targeted categories of subscribers (as defined in Circular L15/3). The investment universe of a ICF can therefore be very broad depending on the investment strategy and profile of the subscriber: the higher the subscriber’s investment and assets, the greater the access to ICFs composed of non-traditional and decorrelated assets. Certain ICFs may contain UCITS, ETFs, structured products, real estate products and listed or unlisted assets.

Freedom and customisation

The ICF offers broader investment opportunities as it provides access to assets not available within a range of external funds, such as structured products. In addition, the subscriber is opting for a fund fully adapted to their investment constraints and objectives.

Portfolio security

In a context of high market volatility, clients are keen to secure and optimise their portfolios. Within a life assurance policy, certain investment options provide a higher level of security and optimum return (although without any capital guarantee). For example, OneLife offers free automatic switching transactions that make it possible to secure capital gains, limit losses and even enter or gradually return to the markets in order to optimise portfolio management and minimise risks. The options can be customised – addressing clients’ specific concerns, saving time and enhancing efficiency.

What are the advantages of ICFs for the client?

- A vehicle managed by a carefully selected and high-quality professional

- An investment strategy aligned with their objectives and constraints

- Access to a broader investment universe than from a range of external funds

- Portfolio security and management optimised through investment options

OneLife is convinced of the high potential of this vehicle and already offers a diversified ICF range to its partners and clients residing in its key markets, a range that the company will continue to expand in 2021 in order to meet market expectations.

Want to know more? Contact our team

You may also be interested in:

Luxembourg: a respected, compliant and secure financial centre