July 28, 2023

A life assurance policy is the consecration of the stipulation for third parties, a mechanism well known to informed specialists. For the others, it should be remembered that life assurance is a policy by which the insurance company (the Promisor) makes an undertaking to the party taking out the policy (the Stipulator), in exchange for payment of a premium, to provide a service (payment to a beneficiary) at a moment determined by the party taking out the policy (either on a given date or on the death of the policyholder)”.

Life assurance has the particularity that the risk is linked to the insured person. The fact that the risk is future and uncertain means that the term of the policy is directly linked to an unforeseeable event, i.e. the survival or death of the insured person at the end of the policy. Finally, the life assurance policy (qualifying in Belgium as “branch 23”) is a financial instrument (similar to a kind of financial will) containing various mechanisms, which may lay the basis for successful wealth planning.

These mechanisms are the result of the policyholder’s exercise of special rights derived from the life assurance policy, with the Belgian Insurance Act of 4 April 2014 as its basis (hereinafter, the “Law”).

These different rights are closely linked to the roles of the different parties to the policy, which should therefore be identified below.

1. The policyholder(s) of the life assurance policy

The policyholder of a life assurance policy (or subscriber) is a natural person or legal entity subscribing to the policy. The subscriber to a life assurance policy enjoys exclusive rights of a personal or property nature.

These rights are listed in the Law

- The right to designate a beneficiary or beneficiaries (Articles 169 et seq.)

- The right to revoke the beneficiary clause (Article 176)

- The right to manage the allocation the underlying investments (switch)

- The right to surrender the policy (Article 178)

- The right to reduce the policy (Article 178)

- The right to advance payment of benefits under the policy (Article 180)

- The right to pledge the rights derived from the policy (Article 181)

- The right to assign (partially or totally) the rights to the policy during the lifetime of the policyholder (Article 183)

- The right to assign (partially or totally) the rights to the policy upon the death of the policyholder (Article 184 of the Law).

In addition, the policyholder of the life assurance policy is the holder of the right to payment of the insurance premium and, correspondingly, the right to stop payment of the premium. The Law in fact establishes the optional nature of this payment (Article 167).

The Law does not prohibit a plurality of policyholders. Even if the Law does not provide for any division of the exercise of rights to the insurance policy between the various policyholders, the majority of the authors considers that the rule of joint management in undivided ownership should apply. In fact, the plurality of policyholders creates a contractual indivision which makes the exercise of the various personal rights to the contract subject to the agreement and cooperation of the various policyholders. The plurality of policyholders, in the exercise of their rights under the policy, will therefore be considered by the insurance company as a single and indivisible entity.

However, it is possible to derogate from this position by agreement, for example using a management mandate in favor of a specific third party. The exercise of the personal rights under the policy will then have to be determined taking into account the contractual provisions in force between the parties concerned.

It should be noted that the personal rights of the policyholder(s) are not life-long and are therefore not extinguished on the death of the policyholder(s), but on the termination of the policy. The rights to the policy are therefore assigned to the heirs of the policyholder, or to any other person contractually identified. In the event of the assignment of the rights of the policyholder to his heirs, the latter may not proceed with any designation of a beneficiary whatsoever, which is a right which can never be exercised by the beneficiaries of the policyholder under the policy.

2. The life assured

The life assured does not have any rights to the life assurance policy. However, the life assured has to sign any application form under the application of Article 102 of the Law, in order to justify the interest to insure. This is valid from the time of application to the settlement of the policy.

3. The beneficiary(ies)

The beneficiary designation is an exclusive but not strictly personal right of the policyholder. The beneficiary therefore depends on the policyholder for the potential triggering on his behalf of a right to payment of the insurance service (in whole or in part).

The beneficiary is not a party to the policy and has therefore no personal right to claim during the life of the insurance policy. His right to claim the insurance benefit only arises at the time of the realization of the risk underlying the life assurance policy, i.e., the survival or death of the life assured – (Article 185 of the Law).

An exception to this principle: if the beneficiary accepts his designation, at the express invitation of the policyholder(s) of the policy, he becomes an “accepting beneficiary” and an active party to the policy, with the consequence that the policyholder(s) will no longer be able to exercise his or her rights of disposal under the policy without his or her consent (except for any right having no impact on the amount the accepting beneficiary is entitled to (such as the right to the information), exercised solely by the policyholder(s) alone).

What is the usefulness of knowing these roles and their rights in relation to estate planning ?

Since the Law does not limit the number of policyholders, lives assured or beneficiaries of a policy, it is possible to use the “life assured” for example in the context of an estate planning. Indeed, if the policy is taken out over several life assured, it follows that the policy will only be claimed (giving rise to payment to the beneficiary(ies)) upon the death of the last life assured. Therefore, a contract can be planned for several generations, thereby cushioning the applicable 2% entry tax on the premiums paid (rate applicable to individuals). The object of the planning then becomes the rights linked to the policy, and not the payment of a specific capital.

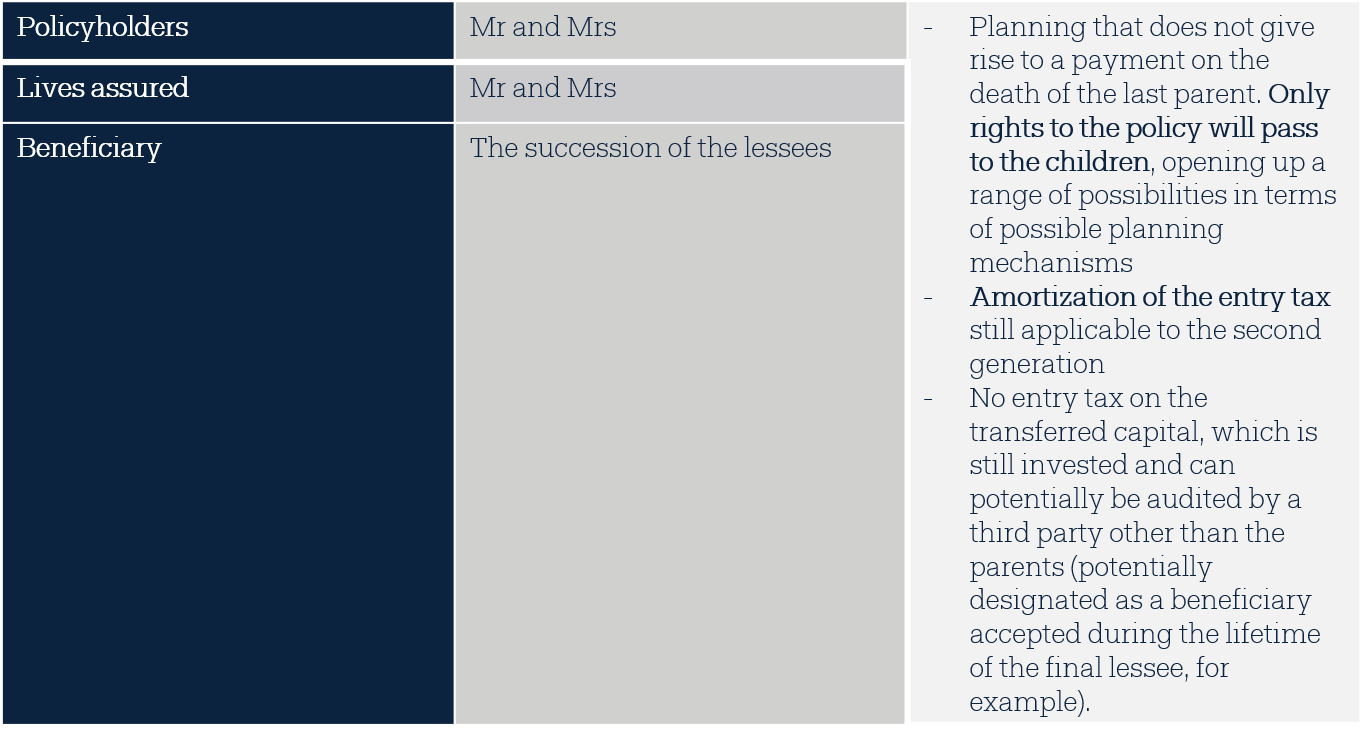

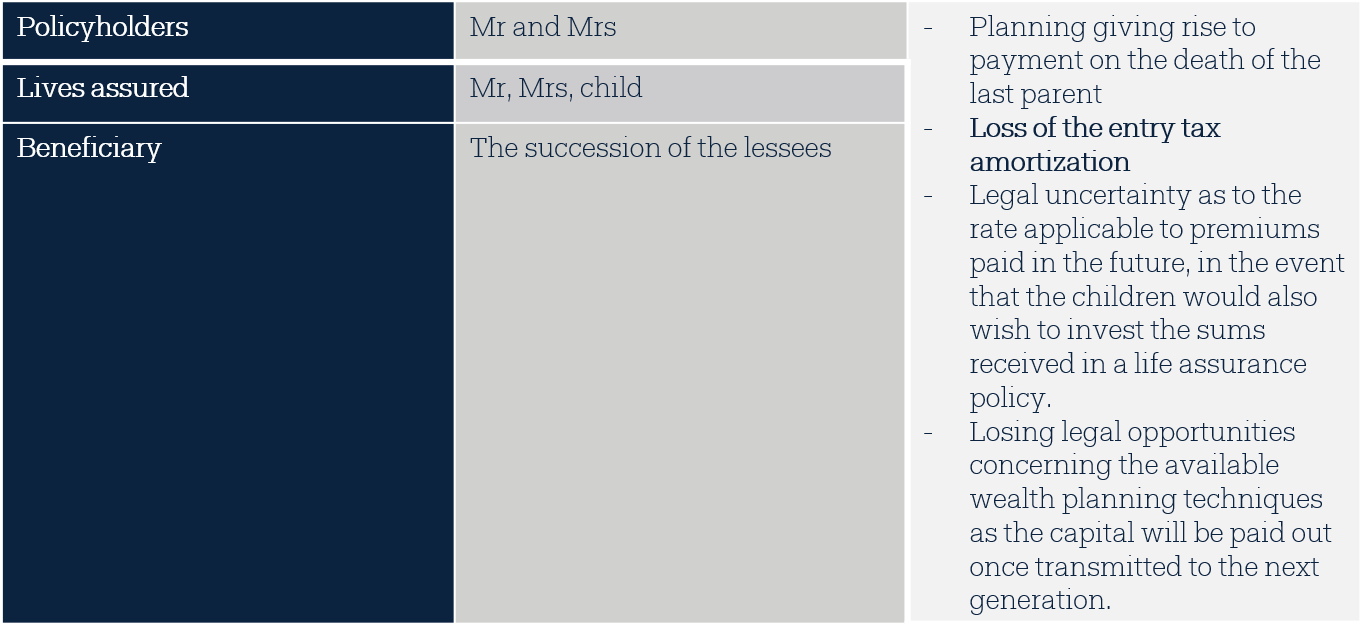

A comparison can thus be made as follows:

Conclusion

The item “lives assured” within a life assurance policy is thus the source of the following points:

- An investment in line with the tax nature of the product itself (medium to long term). A life assurance policy is usually unwound at the death of the (last) life assured, triggering the insurance company’s obligation to pay out.

- The economic amortization of the premium tax on the branch 23 life assurance product

- Legal certainty provided by the payment of the 2% entry tax on branch 23 life assurance products (as the payment is “liberatory”)

- A policy that is always invested when passed on to the next generation is an additional “gift” currently equivalent to 2%.

- Possibility, in view of the provisions of the Law as well as of the structure put in place, to extend the duration of a control over the amounts invested in the name and on behalf of the beneficiaries of the planning by a third party (if, for example, the assignees of the rights to the policy are individuals requiring protection). The law on insurance and in particular the notion of accepting beneficiary would then make it possible, for a policy which has not been terminated, to channel contractually on the life assurance the provisions of an (extra) judicial mandate.

Flexibility in wealth planning. Unfortunately, it is sometimes necessary, for wealth planning purposes (according to the client’s wishes), to proceed to a surrender with reinvestment of the policy in order to modify the lives assured to the policy (necessary reorganization of the structure of the policy), with, as a negative outcome, the payment once again of the 2% premiums tax and the administrative workload of a new subscription. This is no longer the case if the lives assured under the policy allow for an adjustment. Therefore, it is advisable to pay particular attention to this item in the policy (“lives insured”) when it is taken out, in order to cover any event affecting the imagined estate planning over the long term.

To find out more about the advantages offered by Luxemburg life assurance:

- Visit the Our Solutions section of our website

- Contact our teams

![]() Nicolas Milos

Nicolas Milos

Maître en Droit, OneLife External Counsel, specialist in estate planning