November 16, 2023

In Belgium, the purpose of civil law reform on succession and donations was to modernise the inheritance framework of the Civil Code, dating back to 1804. The principles of these reforms have been applicable since 1 September 2018 and have had a major impact on donations and debt being brought back into the estate in order to respect the equality between the heirs and the respect of their reserved share (minimum share made available to each heir by Law). This mechanism is the so-called hotchpot.

In Belgium, the purpose of civil law reform on succession and donations was to modernise the inheritance framework of the Civil Code, dating back to 1804. The principles of these reforms have been applicable since 1 September 2018 and have had a major impact on donations and debt being brought back into the estate in order to respect the equality between the heirs and the respect of their reserved share (minimum share made available to each heir by Law). This mechanism is the so-called hotchpot.

A significant principle introduced by the aforementioned reforms is, without doubt, the modification of the so-called “reserved” and of the “available” share of the assets of any given person.

Notably concerning donations, Article 4.145 of the Civil Code specifies the children’s reserved share to be one-half of the total estate covered by Article 4.153 of the Civil Code, in the following terms: “Donations may not exceed one-half of the total calculation base set out in Article 4.153, if the testator on their decease leaves one or more children, or descendants thereof inheriting by way of substitution.”

It is therefore clear that any estate can be divided into two equal parts: the reserved share for the children (regardless of the number of descendants) and the available share of the Estate. This affects any donation that may have been granted, which will be allocated as follows:

- To the available share: this is recognised as a privileged donation falling outside the scope of the share of the estate; or

- To the reserved share: this is recognised as an anticipated inheritance.

Hotchpot applies to any heir who accepts their succession, with regard to the assets subject to hotchpot and in value (on the day of donation, indexed value). It is therefore entirely feasible for a donor to formally dispense the beneficiary of the donation from any hotchpot with the estate. The object of the donation therefore generally emanates from the available fraction of the donor’s assets. If this is not the case, action for reduction may be taken by a heir whose succession rights have been compromised (and did not receive his full reserved share).

The notable modifications to hotchpot of donations may be summarised as follows:

- Hotchpot of a donation takes place on the basis of the value of the donated assets on the day of donation, indexed in line with the consumer prices index.

- Hotchpot is conducted by value.

- Hotchpot is conducted by “taking less” or by “paying a sum back to the estate”.

These new features may present a number of difficulties regarding financial asset planning. The value of a security will fluctuate between the day of donation and the date of hotchpot, i.e. the date of decease of the donor (opening of succession = moment of hotchpot).

Donation and the life insurance policy

Any donation conducted by a third-party stipulation in a life insurance policy is presumed to be subject to hotchpot (Art. 188 of the law of 04/04/2014), whereas the pre-reform situation was the reverse: the donation is assumed to have been conducted with exemption from hotchpot. These new principles apply to beneficiary clauses established or modified from 1 September 2018.

Practical case

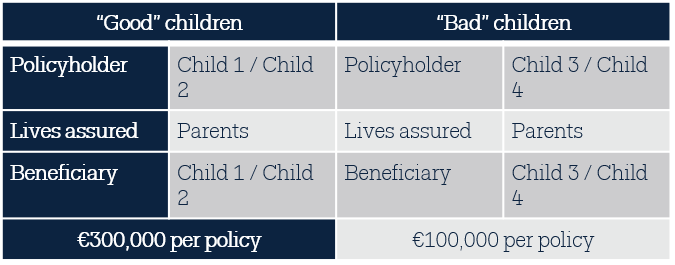

Mr and Mrs Smith have 4 children, of which 2 are “good” children and 2 are “bad”. Mr and Mrs Smith’s assets are value at a total of €800,000, giving a reserved fraction of €100,000 per child. It is the parents’ firm intention for the “good” children to be favoured and for the “bad “children to receive the strict equivalent of their reserved share.

Mr and Mrs Smith are advised to take out multiple life insurance policies in the name of each child concerned, funded using donations of securities, each time with a non-transferability clause (which also affects the hotchpot value). The policies in the names of the “bad” children will not contain any stipulation that payment of the premium constitutes a privileged donation.

How can it be arranged for each to receive the proportion desired by the parents regardless of policy performance? Do the policy and civil law alone suffice?

YES – The policy beneficiary clauses will have stipulated for the “bad” children that there exists an express obligation of partial hotchpot in favour of the “good” children, such that any unanticipated policy gains will oblige them to place the entire policy in hotchpot for division with the “good” children. On the opening of succession, there will therefore be:

- “Good” children policy: €300,000 each (having had poor returns)

- “Bad” children policy: €200,000 each (having had good returns)

- Total estate: €1,000,000

Conclusion

The parents’ wish was to ensure that the “good” children are favoured over the “bad” children and to restrict the latter to their reserved share, i.e. €125,000 each. The “bad” children’s policies will be placed in hotchpot on the opening of succession, each in the amount of €200,000. The “good” children also, yet without any division obligation provided the reserved fraction of the others is not compromised.

Want to know more about the opportunities offered by Luxemburg life insurance?

![]() Nicolas Milos

Nicolas Milos

Maître en Droit, OneLife External Counsel, specialist in estate planning