December 1, 2023

On the occasion of a webinar organised by OneLife for its Belgian brokers, Stefan Duchateau, Professor of Portfolio Management and Financial Risk Management at KU Leuven and UHasselt, addressed the following topics: Which macroeconomic analysis tools are taken into account in portfolio management? How can these tools be seamlessly transposed to produce results through precise choices of sectors, themes and companies?

Here are the main points of his macroeconomic analysis.

Fallen angels… an investment opportunity

The majority of US companies have now published their operating results for the (much feared) 3rd quarter of 2023. In 81% of cases, S&P index companies managed to exceed initial earnings expectations by up to 7.1%.

The previous quarter therefore marks a break in trend after a lengthy series of negative figures. However, this unexpected upturn has not fuelled a sharp rise in equity prices. With an average increase of 0.8%, companies with surprising results received very little reward for their performance (at least for now). Negative surprises were in the minority and led to an average correction of -5.2% – the most severe punishment since 2011.

But we could have feared an even worse scenario: among the group of companies that managed to (comfortably) beat their initial earnings forecasts for the 3rd quarter, some cautiously downgraded their growth prospects for the 4th quarter of this year, resulting in even harsher punishment.

Such price falls are mostly exaggerated and therefore provide an investment opportunity. These fallen angels, which will see their share price gradually pick up over the coming months, are well deserving of a place in our stock selection, along with the broad range of companies in Consumer Durables, Communication Services and Technology, each time managing to beat their earnings forecasts.

Nevertheless, trying to assess the US stock market is certainly still something of a high-wire act. Indeed, the very low level of average risk premium[i] offered is largely explained by the presence in stock market indices of just a few stocks of very large growth companies with stratospheric price-to-earnings ratios.

The value of equities in the mid & small caps segment remains very moderate. For the most part, this is certainly a reflection of their faltering growth prospects over the next two or three quarters. The economic context in the short term seems bleak to say the least, after the apparently endless salvo of interest rate hikes by the US central bank over the past 18 months in a desperate attempt to put the brakes on the economy and, in doing so, to curb inflation.

The Fed has not achieved either of these objectives, but high interest rates (both at the short and long ends of the yield curve) will exert their disastrous effects over the coming months.

« It’s the demography, stupid! »

Meanwhile, the labour market is already showing cracks. Job creation is slowing, while the amazing figures of the recent past are also being adjusted downwards. The central bank sees this as the fruit of its monetary policy, but this could not be further from the truth. The countless jobs lost in the first months of the pandemic have simply been restored over the past 18 months (hence the very buoyant labour market), but this catch-up process is now almost complete. Wage increases remain subdued for the time being and workers seem satisfied with the real increase in their purchasing power, now that inflation is falling, slowly but surely.

Central banks and many analysts continue to marvel at the continued strength of the labour market and the clear determination of the economy to see off collapse, despite the battering from interest rates and geopolitical tensions. But the explanation is simple: if the labour market is currently so robust (and will remain so over the next few years), it is because of the serious shortage of new workers needed to replace baby boomers, who are currently leaving the labour market en masse to enjoy their retirement.

“It’s the economy, stupid!” was the mantra of Bill Clinton’s (winning) election campaign in 1992 against the outgoing president, George H. W. Bush[ii], who had not understood that the heavy burden of the 1991 economic recession would hit him at the polls[iii], costing him his re-election to the White House. A variant of this shock phrase summarises the current economic context as well: “It’s the demography, stupid!”

In such a context, the most successful strategies are therefore implemented by companies able to automate on a large scale. This assumption is therefore one of our main drivers of investment.

Tentative attempt to cut interest rates

On the European continent, a similar favourable constellation is emerging in labour markets, although the growth potential is much more limited. Corporate earnings for the previous quarter, with the exception of some laudable efforts, are also tending to be revised downwards.

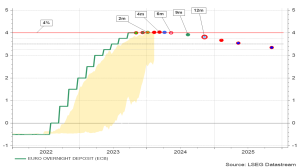

Expected change in the European key interest rate :

In the eurozone, meanwhile, the upward pressure on key rates has completely dwindled away and even creates some slack for highly desirable interest rate cuts to stimulate economic growth on the Old Continent. Moreover, given countries’ dire fiscal context, such a reduction would be more than welcome.

The sharp fall in commodity, energy and food prices allows such an adjustment to monetary policy. But the same bleak analysis by the ECB, which led to an unwelcome salvo of key rate hikes over the past 18 months, is now preventing price falls from accelerating. Unfortunately, we therefore do not expect a first tentative attempt to cut interest rates before the second half of 2024.

In the United States, however, the interest rate fire is still smouldering, threatening to ignite whenever a microphone is placed under the nose of one of the Fed’s governors or its chairman. However, despite the Fed’s inflexible stance, financial markets remain decidedly motionless. They believe it to be highly unlikely that official interest rates will rise again. From June 2024, a series of tentative interest rate cuts are even envisaged. This expected improvement is largely sufficient for equity markets.

Despite the sharp rise in financing costs, the disconcertingly slow decline in core inflation, the unfavourable economic outlook for the next two quarters and dramatic geopolitical events, the NASDAQ and S&P Composite indices managed to post the longest series of consecutive share price increases in two years, even though the spreads between companies have been at their highest since 2018.

And what about bonds?

In stark contrast to the bravura of equity markets, government bonds continue to drift aimlessly, like a shipwreck with the tide. But here too, a turning point is taking shape – slowly but surely. The yield offered by government bonds has now increased enough to be an attractive investment alternative. On the downside, worsening public finances worldwide, growing geopolitical threats and massive sales of government bonds by the ECB and the Fed limit the earning potential of fixed income assets. This delicate environment therefore prevents us from making the big leap in terms of fixed income positions in our asset allocation.

Of course, we need to integrate the increasing geopolitical confrontations into the analysis, as the risk of further escalation is particularly high. The most well-informed commentaries in this regard are somewhat reassuring, yet without detracting from the dehumanising nature of these conflicts. In this regard there is yet another concerning factor in global developments, where fanatics and the short-sighted are gaining the upper hand over their more thoughtful, and therefore more circumspect, peers. Bertrand Russel[i] already warned us 70 years ago about the consequences of a strategy based on such an attitude: “The whole problem is that fools and fanatics are always so certain of themselves and wiser people so full of doubt.”

[i] Bertrand Russell (1872-1970) was a world-renowned British philosopher, writer and humanist.

[i] The risk premium is the additional remuneration included in the valuation of the shares to offset future risks.

[ii] George Herbert Walker Bush, not to be confused with his son George Walker Bush or his (wealthy) nephew George Herbert Walker, IV.

[iii] In March 1991, President Bush still had the highest approval rating in US history (following the Kuwait war). But his star tarnished very quickly after the severe economic recession in the United States later that year.