September 8, 2023

The wording of the beneficiary clause of a life assurance policy is of great importance in order to best meet the client’s wealth planning and succession objectives. This especially applies if the policy is to be donated.

1. The regions of Wallonia and Brussels are coming into line with the region of Flanders.

The tax treatment of life assurance policy donation and succession rights is covered by Article 8 of the CDS, the estate duties code. In this regard, both the Brussels region ordinance of 6 July 2022 and the Wallonia region decree of 22 December 2021 have made significant modifications to the tax treatment of inheritances in relation to life assurance policies.

One major modification is without doubt the change affecting vertical wealth planning (notably in favour of the second generation) which unavoidably impacts any ‘donation’ of a life assurance policy (Article 8, subpara. 7-8 CDS).

2. Legislation applicable to insurance donations

On first reading, this section of Article CDS suggests that it is now mandatory when donating a life assurance policy to the beneficiary that the transaction must be registered and that the registration fees applicable to securities donations must be paid, in order to reduce the inheritance tax base on the decease of the donor.

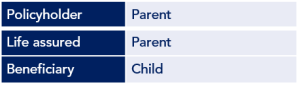

For example, let us take a typical policy structured as in this example when it is taken out:

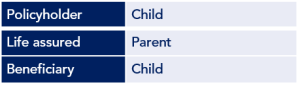

In order to avoid death duties on the life assurance amount invested with regard to the child, the rights of the policy are then donated. The child then becomes the policyholder, suggesting that the policy no longer forms part of the donor parent’s estate but of the child, thereby avoiding death duties on the asset.

In order to recognise this donation transaction, the legislator is now demanding payment of duties on the transaction. The law is strongly encouraging the payment of donation duties in order to recognise the donation transaction performed on the life assurance policy. One might think that it is no longer possible to “donate” a life assurance policy indirectly, i.e. avoiding the application of death duties subject to a contingency period (3 years in the regions of Brussels and Flanders and 5 years in Wallonia). The wording of the law also leads one to conclude that any capital gain realised on the policy between the time of its donation and the decease of the donor would automatically entail the application of death duties, as the reduced registration fees applicable to securities donations had never been paid for this element of the policy.

For example, if a policy is worth EUR 100,000 on donation and fees of 3% have been paid for the donation transaction, and the policy still being invested has a value of EUR 120,000 on the decease of the donor, then the total tax base of EUR 120,000 will only be reduced by the amount to which donation duties have been applied, i.e. EUR 100,000. Consequently, the remaining EUR 20,000 will remain subject to death duties.

3. Options?

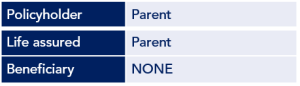

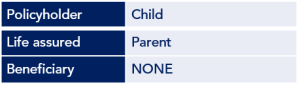

It is nevertheless possible to avoid such taxation of the “policy capital gain” and to easily exploit the benefits of indirect donation of a life assurance policy, notably by taking account of the fact that, in order to be applied, the law requires the presence of a third-party stipulation (stipulation pour autrui) within the life assurance policy. In other words, the third-party stipulation presupposes the designation of a named beneficiary.

+ assignment of all the rights over the policy (donation), registered or otherwise

In the absence of a named beneficiary being designated in the beneficiary clause of the life assurance policy prior to any “life assurance policy donation” transaction, it will not be possible to apply Article 8 CDS, and to demand payment of donation duties in order to recognise the life assurance policy donation transaction. It is therefore necessary to avoid designating any named beneficiary in the beneficiary clause of the life assurance policy by, for example, deleting all content from this section and replacing it with the word “None”, or equivalent wording.

Conclusion

In order to retain maximum wealth planning flexibility for a joint application, it is strongly recommended to maintain your options by not designating any named beneficiary. Not designating a named beneficiary also enables the parent policyholder to donate (subject to possible tax inspection) all their rights under the policy to a given person, further avoiding future death duties on any “capital gain” (i.e. higher net surrender value between the time of donation and the decease of the donor), whether or not the donation has been registered, once the settlement of the estate has commenced.

This administrative step therefore maintains wealth planning flexibility while providing legal certainty regarding the ultimate tax treatment being sought for the underlying sums of the life assurance policy.

Would you like to know more about the wealth structuring options offered by a life assurance policy?

– Discover or rediscover the article “Dismemberment of ownership and life assurance – new opportunities”. In practice, dividing ownership rights certainly represents a key element of wealth planning strategy in Belgium.

– Contact our teams

![]() Nicolas Milos

Nicolas Milos

Maître en Droit, OneLife External Counsel, specialist in estate planning