February 27, 2023

In the last quarter of 2022, the Spanish Central Government introduced the so-called Solidarity tax, which “mirrors” in essence the long-standing Wealth tax. Under this new tax, it has been decided that no regional tax credits or exemptions would apply, which implies that, for example, residents in Madrid or Andalucía may be severely impacted.

Indeed, so far, such regions were totally exempting Wealth tax, while in contrast, other regions where Wealth tax was also applicable (and no significant tax credits or exemptions were granted), the negative impact could be lower as the new tax measure allows to deduct from the tax liability any potential Wealth tax effectively paid at regional level.

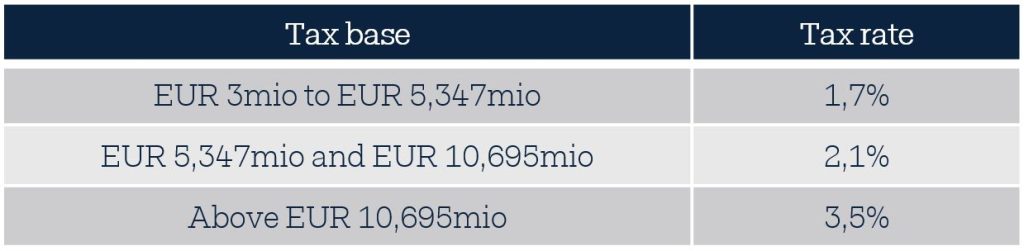

The new “Solidarity Tax” is configured as follows: when the tax base of the tax payer exceeds EUR 3 million a tax of 1.7% applies for the part up to EUR 5,347 million with a marginal tax of 3,5% for any amounts exceeding EUR 10,695 million, and a tax of 2,1% for the bracket in between.

Let’s take an example

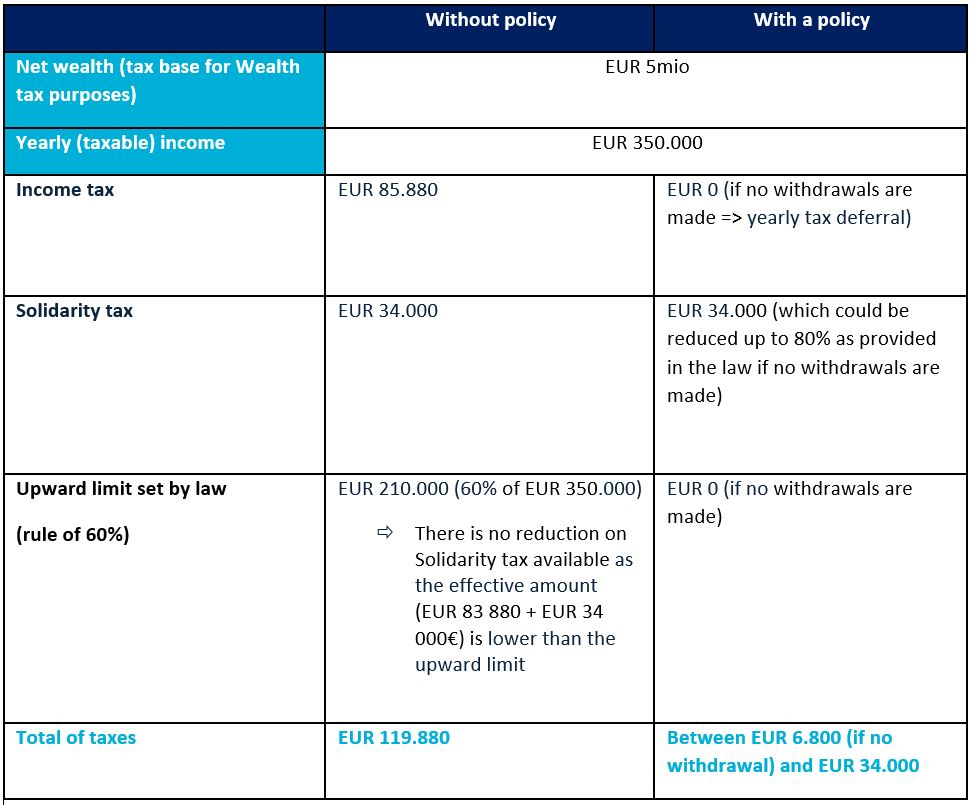

An Andalusian resident has a net wealth of EUR 5 million (i.e. tax base for Wealth tax purposes) and a yearly (taxable) income of EUR 350.000. If we keep in mind that currently no Wealth tax applies in Andalucía, the impact of the newly introduced Solidarity tax for our fictive client could be EUR 34.000 (1,7% of EUR 2 million), since for the bracket between EUR 3 million EUR and EUR 5,347 million, a tax rate of 1,7% applies.

However, in case the aforementioned Andalusian resident opted for a life assurance policy, the Solidarity tax charge could be reduced up to 80%, as provided in the law, and a clear tax benefit would be provided for Income tax purposes, since a tax deferral applies in a policy as long as no withdrawals are made. So, the Solidarity tax amounting to EUR 34.000 could in that case be reduced to EUR 6.800.

We can notice that it is in fact far more beneficial to take out a policy, as without policy, the sum of the Income tax and Solidarity tax would amount to EUR 119.880 (i. e. EUR 85.880 Income tax + EUR 34.000 Solidarity tax), and no tax reductions on Solidarity tax would be available, as the upward limit set by law (60% rule) is 60% of EUR 350.000 which is EUR 210.000.

To summarize our client case

We can therefore conclude that taking out a life assurance policy may well help many clients which will be adversely affected by the introduction of the Solidarity charge, especially in those regions where the regional Wealth Tax did not have any practical effect before.

=> Download our dedicated factsheet

Want to know more about opportunities offered by Luxembourg life assurance?