September 19, 2016

The wealthy often get a bad rep and are portrayed as the greedy, fat cats of society.

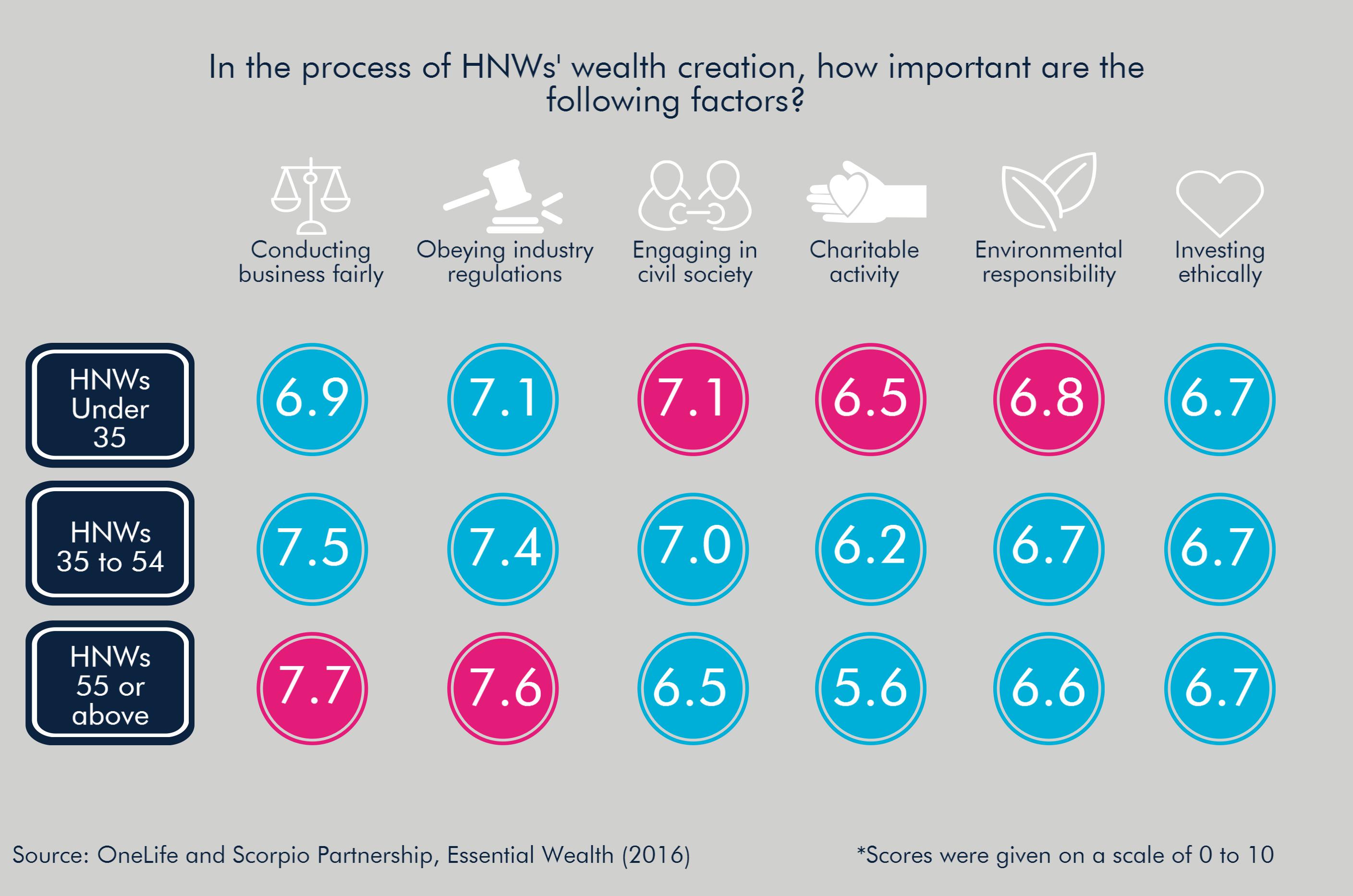

But actually, we have found that this could not be more incorrect – results from our report have showed that when it comes to wealth creation, HNWIs believe that obeying industry regulations, carrying out fair business practices and paying taxes compliantly are all of utmost importance.

In fact, 6% of HNWs readily admitted that they believed they should be asked to pay more taxes! Similarly, these European HNWs were very keen to emphasise that one of their main goals was ensuring their children would share similar attitudes to society, seeing social responsibility and philanthropy as an obligation they should take on whole-heartedly.

As such, the advisor working with HNWs plays a hugely important role in ensuring their clients receive the best possible advice and more up to date industry information. Previous research we have done however, found that a large number of these HNWs do not even have a professional advisor.

So perk up your ears, advisors!

Here’s a tip – millennials are the critical segment to target as we believe it is never too early to receive financial advice. Although claims that the younger population of wealthy individuals as digital natives will prefer to use robo-advice are abundant, a personalised approach can help them prepare better for the medium to long-term financial view.

Advisers can be the guardians of their wealth, accompanying them throughout their life journeys, paving their way to success from an early start. Our ‘Essential Wealth’ report is now available for download.

Click here to get your hands on a copy!