June 3, 2022

It is always possible and even advisable to anticipate the transmission of one’s wealth as early as possible, and for this to consider inter-vivos gifts. In case of intergenerational transmission, it could be possible to benefit from an allowance which is renewable every 15 years, of €31,865 per grandchild and €5,310 per great grandchild. Above these amounts, the funds are taxed according to the sliding scale (in direct line) with a marginal rate of 45% above €1,805,677.

The manual donation of cash can also be used to anticipate the transmission, in this case, and subject to conditions, an additional allowance of €31,865 per 15-year period is available.

Although donation is an option not to be neglected to initiate intergenerational transmission, the available allowance remain limited. In addition, it is irrevocable, meaning that once the funds have been transferred, the donor can no longer go back, even if their financial situation changes.

In the presence of children, transmission to future generations can also be carried out at the time of succession within the limit of the available amount (“quotité disponible”). The allowance will then amount to €1,594 per grandchild or great grandchild. The scale of taxation is identical to that set out above.

Moreover, taking out a life insurance policy can offer interesting flexibility. Indeed, if the grandchildren or the great grandchildren can be designated as beneficiaries directly, it is also possible thanks to the adapted wording of the beneficiary clause to combine direct-line transmission and intergenerational transmission depending in particular on the situation of the various parties at the time of the settlement of the policy. The advantage of this solution lies in his flexibility not only of the life of the policyholder who remains free to surrender according to their needs, but also at the time of the death of the latter then leaving the possibility of implementing intergenerational transmission only if the children do not need the funds.

Waiving the benefit of the policy

What does this mean, and how do I do it?

Waiving the benefit of the policy means not accepting the benefit of a policy of which one is the designated beneficiary. The consequences of the waiver will depend on how the beneficiary clause has been drafted (second-rank beneficiary, intended representation, increase clause, etc.). It is therefore essential for the policyholder to draft the beneficiary clause accordingly.

Waiving the benefit of the death benefits constitutes a personal right of the beneficiary. It is final and cannot be partial (the waiver must be pure and simple). Furthermore, it is not possible to waive one’s beneficiary rank, the waiver occurs on the benefit of the policy as a whole.

Furthermore, as life insurance is considered to be outside the estate[1], the waiver of the benefit of the latter must be distinguished from the waiver of the estate and does not entail any consequences on the estate (and vice-versa). Indeed, it is on the due date of the benefits, i.e. on the day of death that the determination of the beneficiaries is assessed. As specified by article L132-8 of the Insurance Code[2], in the event of a waiver of the estate, the persons being designated as beneficiaries of death capital through the qualification of “heirs” do not lose their right to receive the death capital from the life insurance contract.

Further to the waiver, and for the computation of inheritance tax that would be payable, the parental link to be taken into account is the link between the second beneficiary (i.e. who actually receives the funds) and the assured person.

If no formalism is legally required, it is necessary to bring this waiver to the insurer’s knowledge.

N.B. In order to avoid the risk of any requalification as a gift, the waiver “for the benefit of” must be avoided.

What is in the interest of organising this waiver of the benefit of the policy?

Where the beneficiary clause is drafted in such a way as to provide for the case where the first-rank beneficiary does not need the death capital, he/she is free not to accept them in order to allow the transmission to the following beneficiaries.

Depending on the age of the first-rank beneficiary or their needs at the time of the settlement of the policy, it may be appropriate for them to waive the benefit of the policy so that the transmission takes place directly to the children/grandchildren (second-rank beneficiaries). In some cases, and in particular when death capital is subject to article 990 I of the French General Tax Code (“GTC”), this allows the benefit of the allowance of €152,500. The transfer then benefits from a favourable tax treatment that would not be available if it were carried out only on the death of the surviving spouse or first-rank beneficiary parent.

The waiver facilitates the direct transmission to the next generation and avoids the double taxation linked to successive transmissions to the children and then to the grandchildren.

In addition, the transmission through life insurance policy is outside the estate, meaning that the death capital paid to the beneficiaries will not be taken into account when settling the estate and calculating the hereditary reserve[3].

N.B. Regular updating makes it possible to monitor the changes in the client’s personal situation and objectives. In addition, any change in the beneficiary clause must be notified to the insurer in order for the insurer to be able to proceed with the settlement in accordance with the policyholder’s will.

Examples of beneficiary clauses and their impact in the event of waiver

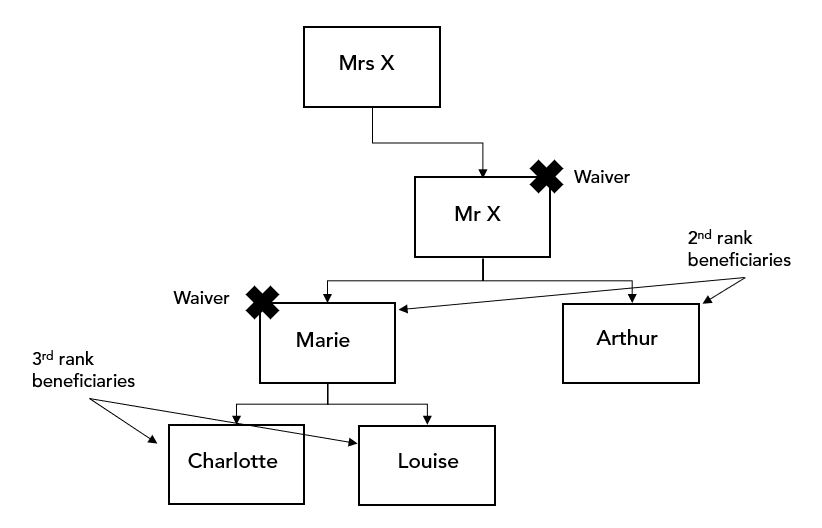

We will assume that at the time of Mrs X’s death, Marie has sufficient assets, including life insurance policies on her behalf (with premiums paid before 70 years of the assured life) for an amount greater than the available allowance.

Case no. 1 – Absence of second-rank beneficiary

“My son Arthur X. born on 6/4/1980”.

In the absence of a second-rank beneficiary, the death capital incorporates the estate and will be subject to classic inheritance taxation[4], without being able to benefit from the favourable tax regime of life insurance.

Case no. 2 – Successive beneficiaries and planned representation

“My married spouse, not separated in law, or my partner in a Civil Pact of Solidarity; failing this my children, born or to be born, in equal, living or represented shares, the representation applying in the event of prior death or waiver; in the event of prior death or waiver of one of my children, and their representatives, their share will return equally to my other children, living or represented, with the representation applicable in the event of prior death or waiver; failing this, my heirs. ”

If, at the time of settlement, the spouse does not need the funds, she/he may waive the benefit of the policy, the death capital will be allocated directly to the children. If one of the children renounces, death capital will then be allocated to their descendants. The wording of this clause makes it possible to allow the child or grandchild to benefit from the favourable tax regime of life insurance while maintaining some flexibility depending on the needs of all.

Overview of the impact of Marie’s waiver on the net amount received by Charlotte and Louise

- Death capital €600.000

- Premiums paid before 70 years of the life assured

Without waiver

- Transmission to Marie and Arthur: €300,000 each

- Allowance of €152.500

- Tax (20%): €29,500

- Net amount received: €270,500

- Transmission to Charlotte and Louise: €135,250 each

- Ordinaryallowance not available

- Inheritance tax: €25,244

- Net amount received: €110,006

Net amount received by Charlotte et Louise without waiver: €110,006

With waiver

Transmission to Charlotte et Louise: €150.000 each

- Allowance of €152.500

- Net amount received: €150,000

Net amount received by Charlotte and Louise thanks to the waiver: €150.000

Want to know more? Contact our teams.

The following topic may also be of interest to you:

Life insurance and transfer of wealth – OneLife

[1] Article L132-12 of the French Insurance Code.

[2] “The heirs, thus designated, are entitled to assurance in proportion to their hereditary shares. They retain this right in the event of waiver of the estate.”

[3] Provided that the premiums are not manifestly exaggerated.

[4] Art. L. 132-11 French Insurance Code.