December 16, 2015

Unsurprisingly, high-achieving wealthy individuals believe that quality rather than quantity is the essence of a desirable dialogue. Simply, becoming a ‘trusted advisor’ to HNWI is not about delivering an abundance of communications but rather, about what those communications consist of.

And yet, it’s good to talk. Clients who have lower satisfaction levels hear from their relationship managers less than those who give positive scores.

Source: The Futurewealth Report; Scorpio Partnership, NPG Wealth Management and SEI

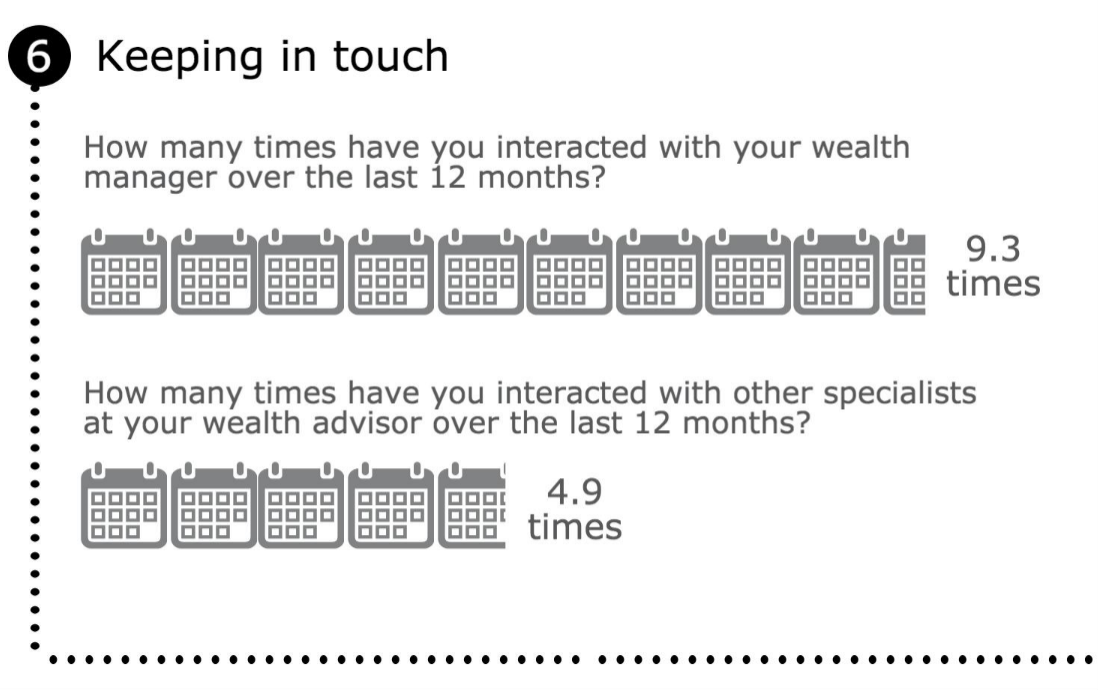

On average, wealthy investors speak to their relationship manager 9 times and other specialists 5 times a year and, broadly, wealthy investors believe that their wealth management firms are getting the fundamentals of the contact strategy right.

At a global level, HNWI believe that many more than 15 connections a year is excessive whilst five to eight are not quite achieving critical mass.