December 14, 2015

When it comes to wealth management, it is no secret that the world’s wealthiest investors are not monogamous. The industry may go to great lengths to court global money-makers but their minds remain open to affairs with other wealth partners.

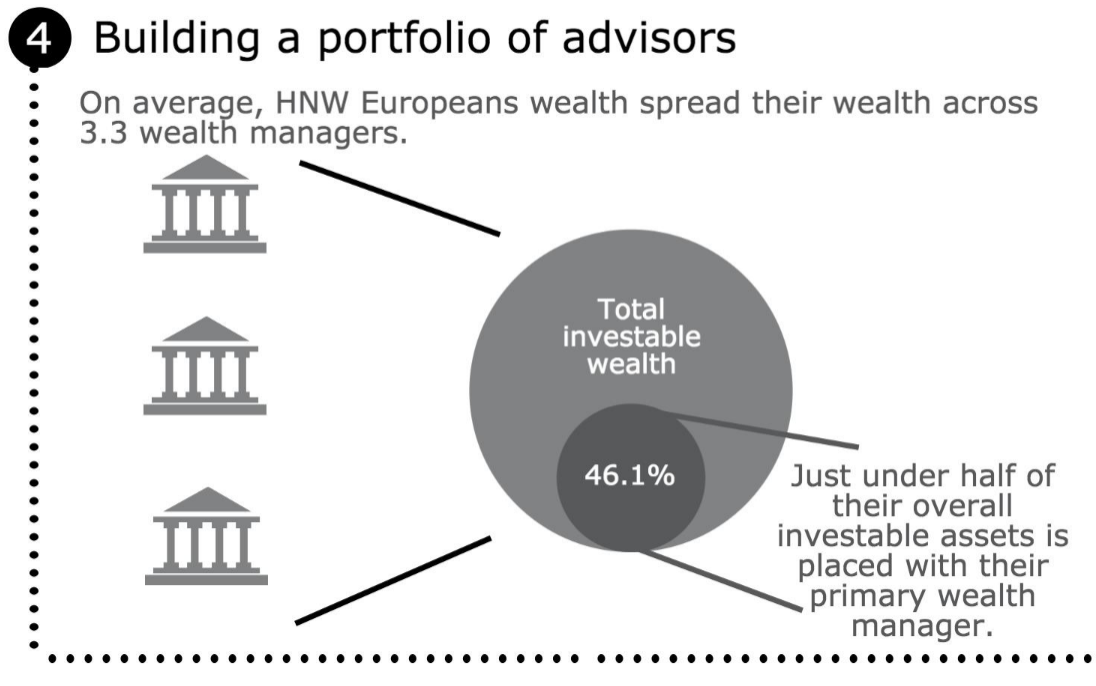

On average, HNW European investors maintain relationships with three wealth managers. To an extent, this collection is a lifestyle choice. After all, the old adage about putting all your eggs in one basket can be no more pertinent than for those at the top of the wealth curve.

Source: The Futurewealth Report; Scorpio Partnership, NPG Wealth Management and SEI

On average, HNW Europeans place just under half of their overall assets (46.1%) with their primary wealth manager. When asked what the maximum proportion of their wealth that they would consolidate with a single provider was, they raised that marginally to 46.7%.

And yet, it appears that many of them do actually want to add to the purse held by their money manager as time passes. The proportion of wealth managed by the primary provider increases with age and the length of the relationship.