June 5, 2018

According to our research, 60% of high-net worth individuals from the UK have a plan in place for the succession of their finances. Despite the expatriate status of the Willems family, who are originally from Belgium, they are no different.

Although they have settled into life in the UK over the past years and have even begun to view it as a home away from home, recent waves in politics have caused them to reconsider.

Now with Britain’s imminent departure from the EU, they are exploring their options when it comes to creating a life assurance policy which has integrated succession planning. However, creating a plan that protects all parties involved and has cross-border capabilities can be a tricky undertaking. Complexities involving tax and domicile status throw curve balls at what should be a smooth sailing planning experience.

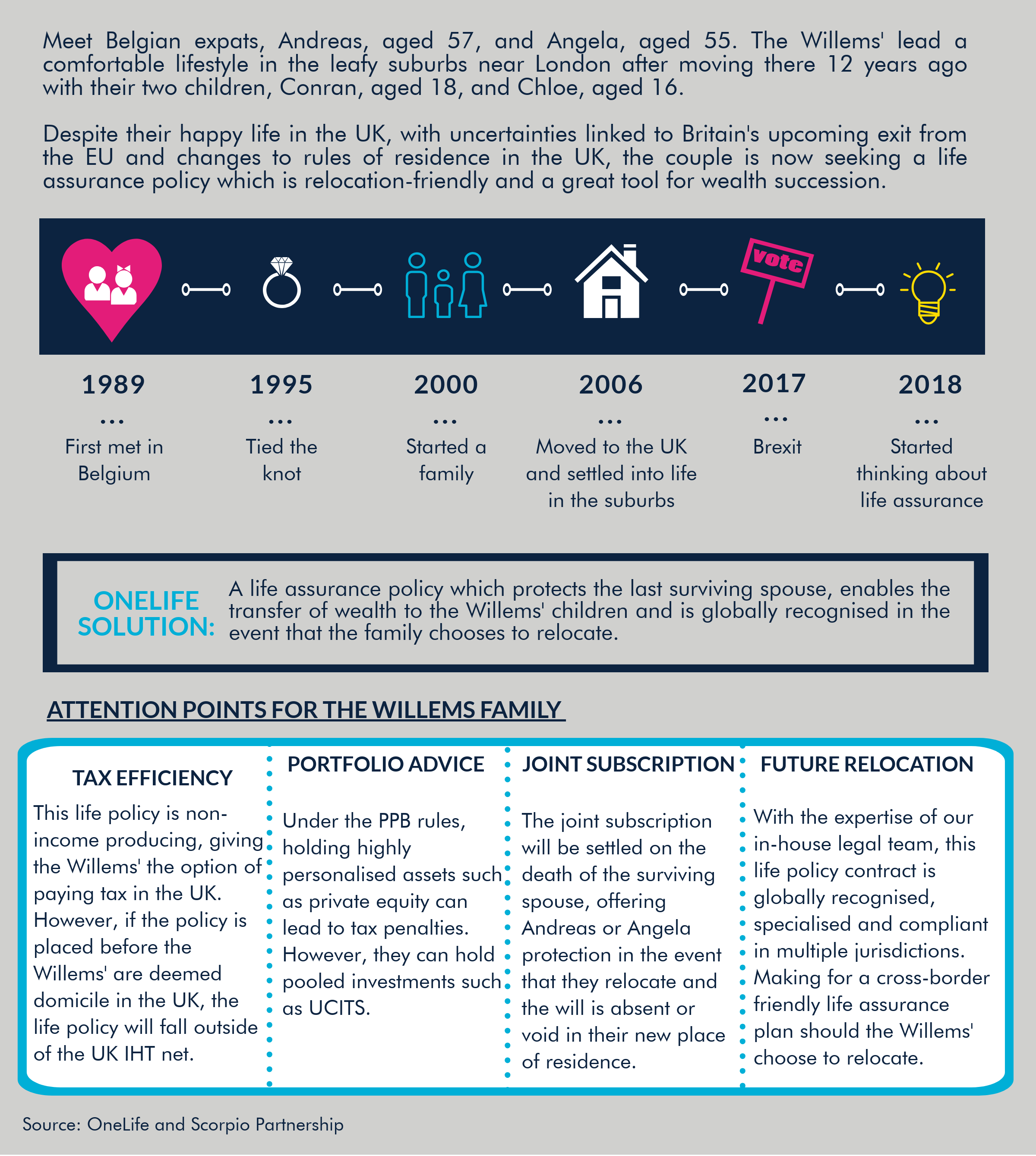

Existing – Meet the Willems family! Meet Belgian expats Andreas, aged 57 and Angela, aged 55. The Willems lead a comfortable lifestyle in the leafy suburbs near London after moving there 12 years ago with their two children, Conran aged 18 and Chloe aged 16.

With the advent of Brexit and the uncertainty that brings, they are starting to consider what the future might hold. Changes to residency rules in the UK are also an important factor which they need to take into account. Andreas and Angela want to ensure that as successful professionals, they can maintain their lifestyle and provide for their children’s higher educational needs as they reach university age. With a Luxembourg life assurance policy and the flexibility that brings, they can be sure that their wealth is protected and transferred to the next generation efficiently, even if they were to relocate to another country.

How? A number of benefits come into play centred around

1. Tax Efficiency – taking out a Luxembourg life assurance policy before becoming domiciled in the UK means is an efficient in terms of inheritance tax (IHT) planning.

2. Portfolio Advice – a Luxembourg policy allows for the holding of a wide range of pooled investment vehicles such as UCITS funds. This gives the Willems the opportunity to hold a diversified investment portfolio as part of their life assurance contract, allowing them to choose their risk profile and switch easily between a wide range of investment funds.

3. Joint Subscription – if both Andreas and Angela subscribe the life assurance policy, they can rest assured that the surviving spouse remains protected in the event of death of the other spouse. In the case where there is no will or the will is void in their new country of residence, this provides peace of mind for the future.

4. Portability of the life assurance policy – OneLife’s team of experts has long experience in assisting clients to manage their wealth in a secure and efficient way. Even when it comes to single or multiple relocations to other countries during the life of the policy, it remains compliant cross-border and flexible enough to take into account the changing needs of the policyholders.)

Discover it all through this video

Each family situation is unique which means that the life assurance policy also must be able to take into account the special circumstances and needs of those involved. With more people than ever relocating to live and work in other countries, factors like cross-border portability are all important. And as family situations become more complex with children also often moving abroad to study and work, finding a wealth planning tool which is flexible enough to evolve around family members’ needs is key. A Luxembourg life assurance contract is an ideal way to protect, manage and transfer wealth in a safe and efficient way.

= > Click here to find out what the OneLife solution is for the Willems family!

Source: OneLife & Scorpio Partnership