June 8, 2017

OneLife did not wait for the 29 May “Lëtzebuerg National Digital Skills and Jobs Coalition” dedicated to bridging the gap in digital skills in Luxembourg to sponsor its Digital Days on the 14th and 15th of June. It will be the starting point for an integrated digital training programme.

For the last two years, OneLife has been transforming itself by making a solid investment in technology and people. Digital has become, in a decisive way, the cornerstone of its evolution.

Many projects have already been delivered in 2016, demonstrating OneLife’s determination to make digital a part of its core business. With an even more demanding programme in 2017, numerous initiatives involving all members of the company will set the pace for the year. The main project is the digitalisation of the on-boarding process, starting with the digital signature and RegTech (KYC/AML).

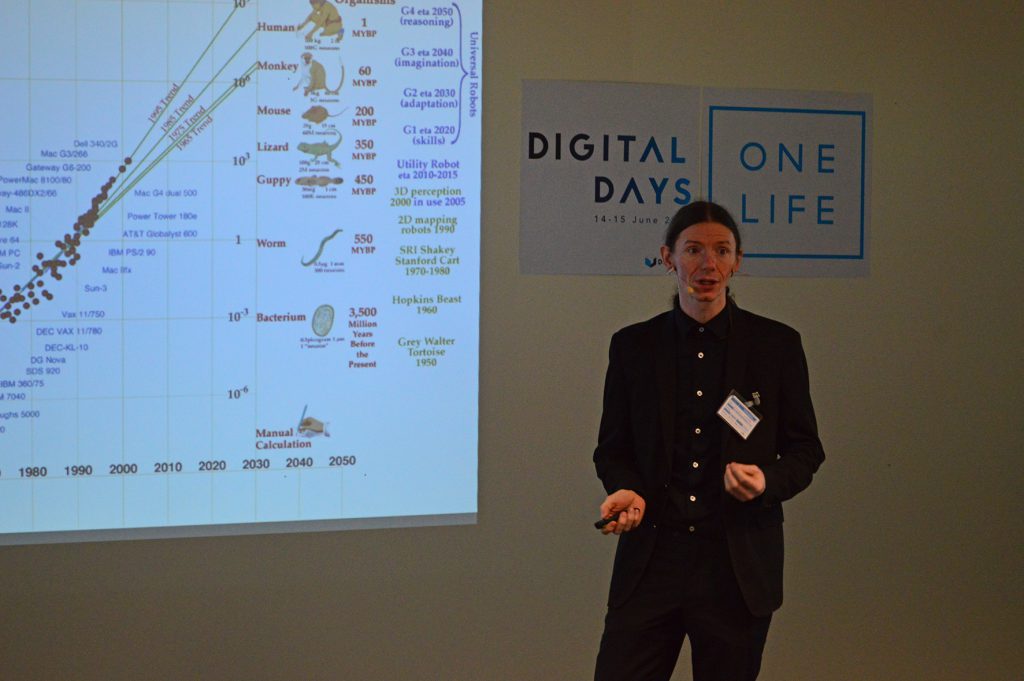

This programme will kick off with the “OneLife Digital Days” on 14th and 15th of June 2017. Two full days to raise our employees’ awareness of what the digital world of tomorrow will be like and its major impact on the job market.

Day 1, 14th June: OneLife employees will have the opportunity in a fun learning environment to fly drones, try out 3D printers and to immerse themselves in virtual and augmented reality. The CEO of Vigo Universal, C. Hermanns, will host the conference, with a goal of taking stock of what myth and reality mean and what new technologies really will change. In May, L’Echo named him as one of 10 Belgians who will change the man/machine ratio

Day 2, 15th June: Through workshops focused on the financial services, employees will be able to professionally integrate the reality of the digital revolution in their work: All the challenges that OneLife wishes to help its employees meet — BlockChain, chatbots, Reg Tech, digital signatures — represent the next steps in its digital roadmap. Nasir Zubairi, CEO of LHoFT (Luxembourg House of Financial Technology), will share his experiences integrating disruptive technologies in the financial sector.