June 15, 2018

Life insurance companies too have found their home in Luxembourg and specialise in life policies linked to investment funds, products that offer clients the combination of life cover and the prospect of financial returns. Life assurance contracts are often linked to dedicated funds, instruments that are increasingly favoured in the wealth management industry today.

Luxembourg is the premier private banking centre in the Eurozone and the second largest fund centre in the world. Its social, economic and political stability makes it an ideal hub for both private and institutional investors from all over the world.

With flexibility and geographic portability key features of a life policy, it is an ideal way for HNWIs and their families to manage preserve and transfer wealth across generations.

With its cross-border leadership on the European scene and extensive expertise, Luxembourg offers unrivalled support in developing global solutions covering multi-jurisdictions while anticipating potential mobility of clients in the future.

In addition, Luxembourg unit-linked policies embed a full range of traditional and non-traditional assets from equities, bonds, money market instruments to real estate, private equity, derivatives, and securitisation. These enable clients to achieve fully-customised strategies in terms of both protection and returns in these days of negative interest rates.

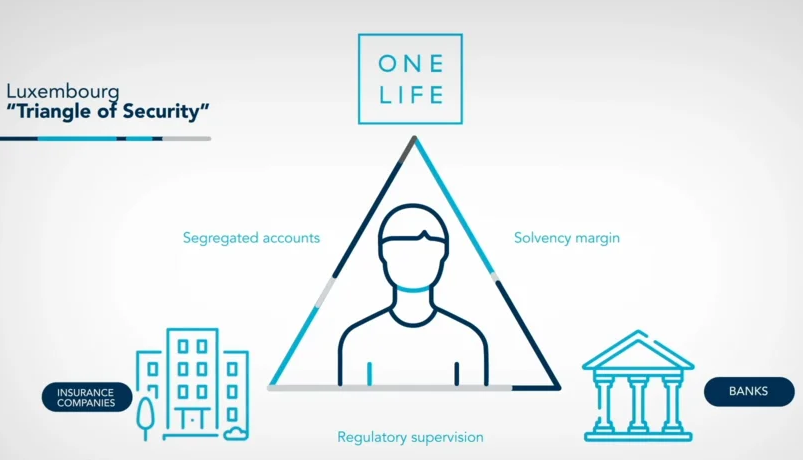

Luxembourg provides maximum security through its life assurance policyholder protection regime. The cornerstone is the legal requirement that all clients’ assets are held by an independent custodian bank approved by the Luxembourg State regulator, the Commissariat Aux Assurances (CAA). This arrangement is known as the Triangle of Security and ensures the legal separation of clients’ assets from the insurance company’s shareholders and creditors as well as a ‘super-privilege’ giving the policyholder first priority in case of default. This protection framework is a criteria for European clients as well as for an increasing number of international clients who may come from less stable countries and who are looking for more secure jurisdictions.

Combining international expertise, protection and flexibility, Luxembourg clearly offers multiple advantages to international investors looking for sophisticated financial and inheritance planning solutions in a transparent and secure environment.

Watch out our latest video to view the multiple advantages of Luxembourg life assurance solutions and how OneLife can help you.