With a strict legal framework focused on protecting assets invested in a policy, and recognised political and economic stability, Luxembourg offers life insurance policyholders an unparalleled level of protection of their wealth.

The protection of the policyholder’s wealth is based on several pillars:

- The Triangle of Security

- The Super Privilege

- The unseizability of wealth

- Luxembourg’s stability and reliability

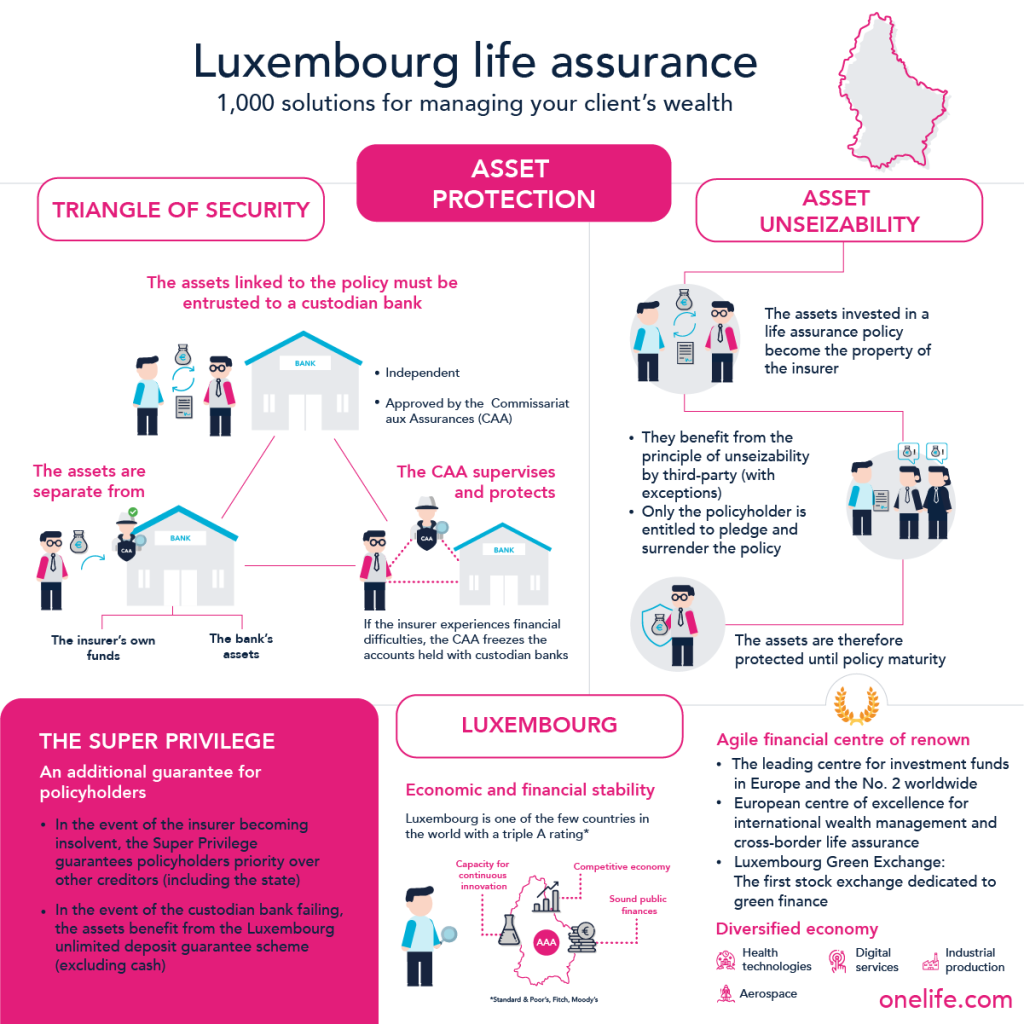

The Triangle of Security: optimal protection of assets

The Triangle of Security governs the custody of the assets invested by the policyholder in their life insurance policy. It is based on a triple mechanism.

- The insurer is legally obliged to entrust the assets linked to the policyholder’s life insurance policy to an independent custodian bank, approved by the Commissariat aux Assurances (CAA), the authority responsible for supervising insurance companies.

- The assets are deposited in an account separate from the insurer’s equity and the bank’s assets. This provision guarantees the policyholder optimal protection in the event of financial difficulties for the insurer and/or the bank.

- The CAA monitors the accounts of the insurer and the custodian bank in order to identify any difficulties as quickly as possible.

In addition, in the event of the insurer’s financial difficulties, the CAA has the power to freeze its accounts with the custodian banks immediately to prevent any transaction contrary to the interests of policyholders.

The Super Privilege and unlimited deposit guarantee, two additional security measures for policyholders

In addition to the Triangle of Security, the Luxembourg legislator has put in place additional protection for the policyholder’s assets: the Super Privilege. In the event of the insurer’s default, this mechanism guarantees the policyholders’ absolute priority over the insurer’s other creditors, including the State.

In addition, if the custodian bank encounters difficulties, the assets entrusted to it benefit from the Luxembourg unlimited deposit guarantee mechanism (excluding cash).

Wealth unseizability: a key feature of life insurance investment

When the policyholder invests assets in life insurance, those assets become the property of the insurer. It cannot therefore be seized by the policyholder’s creditors, and remains protected until the expiry of the policy.

Only the policyholder has the right to:

- Pledge their policy

- Surrender their policy

- Designate or revoke the beneficiaries

No creditor has the power to force the policyholder to exercise these rights (except in the event of tax fraud, criminal investigation or obviously exaggerated premium with regard to their resources and/or assets).

Luxembourg’s stability

The last, but not the least guarantee, offered by the Luxembourg system: the stability of the country, its economy and its institutions.

Economic and financial stability

The Grand Duchy of Luxembourg is one of the few countries in the world with a triple A rating. This is the result of solid public finances, a competitive economy and a permanent capacity for innovation.

Reputable financial centre

For several decades Luxembourg has had a unique reputation as an international financial centre:

- It is the second largest investment fund centre in the world, and the first in Europe

- It has for years been the European centre of excellence for international wealth management and cross-border life insurance

- It saw the creation of the first stock exchange dedicated to green finance, the Luxembourg Green Exchange (LGX)

- It is the global leader in international funds investing in China

- It has a national platform dedicated to the development of Fintech

The Luxembourg government and financial sector players are aware of these strengths and work to maintain and strengthen Luxembourg’s position as a leading financial centre, open to internationalisation and focused on innovation.

Diversified economy

While the financial industry is important for Luxembourg, it is far from the only sector that the country can rely on for its development. Luxembourg companies are active in aerospace, digital services, logistics, healthcare technologies, industrial production ….