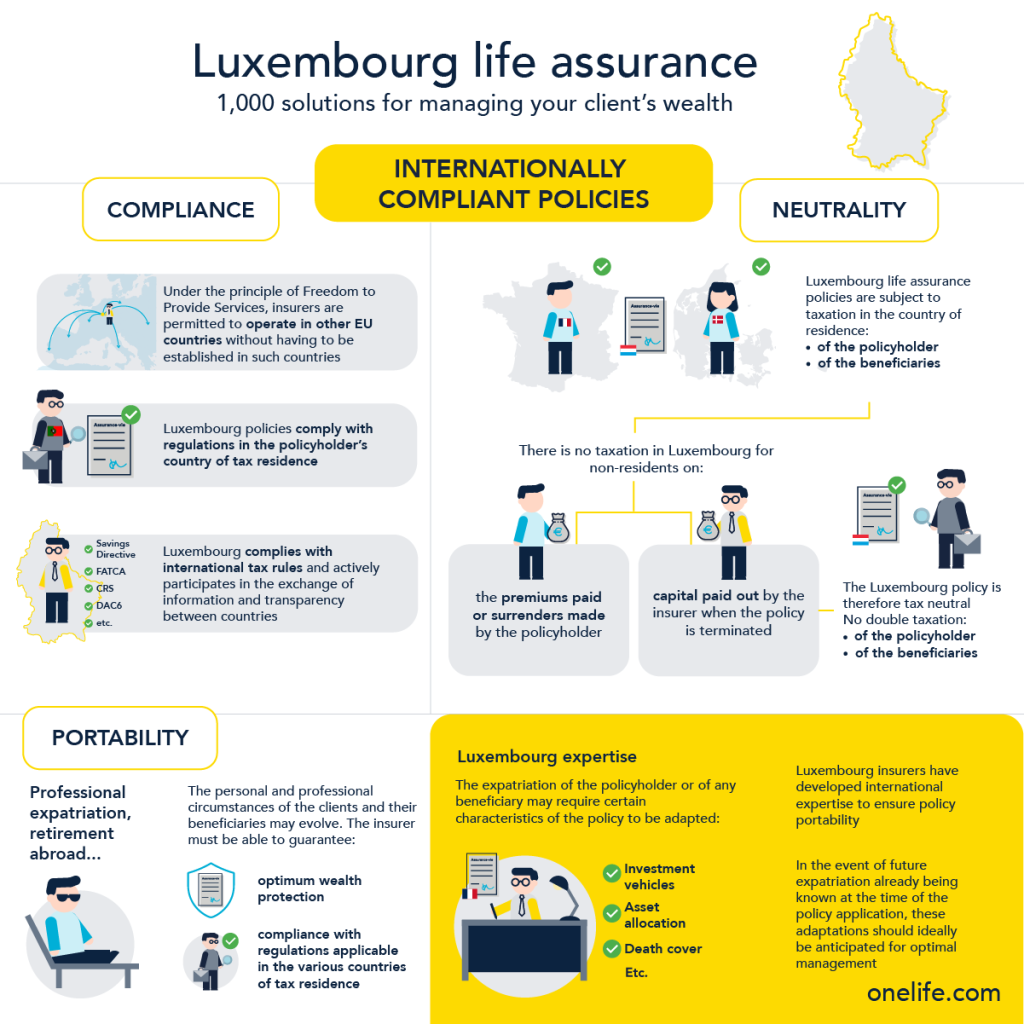

Luxembourg life insurance policies are designed to comply with international legal and tax standards and thus offer the possibility of genuine cross-border management of policyholders’ assets.

Since the publication of the European Directive on the Freedom to Provide Services, a European policyholder can freely conclude their assurance policy in any country of the European Union. The Grand Duchy of Luxembourg has been a pioneer in the application of this directive and has become a centre of expertise in cross-border life insurance over the years.

This expertise is structured around three pillars:

- Compliance of policies with international rules

- Tax neutrality (no double taxation)

- Portability of the policy in the event of expatriation

Policies compliant with international investment rules

Luxembourg life insurance policies comply with the legal and tax obligations of the policyholder’s country of residence.

In addition, Luxembourg complies with international tax standards, and in particular international conventions relating to the exchange of information and tax transparency: Savings Directive, FATCA, CRS, DAC6, etc.

True tax neutrality

Luxembourg life insurance policies are subject to taxation in the country of residence of the policyholder and the beneficiaries.

Non-Luxembourg residents are therefore not subject to any tax in Luxembourg, whether on premiums paid, surrenders made or capital paid by the insurer following the termination of the policy.

These provisions guarantee veritable tax neutrality for policyholders and beneficiaries: they are only taxed in their country of residence while benefitting from the international framework of Luxembourg policies, and in particular their portability in the event of international mobility.

Portable assurance policies in the event of expatriation

Whether it’s new career developments or a pension-related choice, international mobility is growing steadily.

For life insurance policyholders as for their beneficiaries, this means guaranteeing:

- Optimal protection of wealth even in the event of a change in country of residence

- Compliance with the rules in force in the various countries of tax residence

Features of our international life insurance policies

Luxembourg life insurance companies have developed unique international expertise and are thus able to ensure the portability of the policy in most situations.

An expatriation may require the adaptation of different characteristics of the policy:

- Investment vehicle

- Asset allocation

- Death cover

- etc.

The insurers’ wealth management teams are able to advise policyholders and their intermediary on the best way to adapt the policy in order to secure the wealth and benefit from the most favourable tax treatment in accordance with international rules.

When expatriation plans are already known at the time the policy is taken out, insurers anticipate future adaptations and select the most appropriate structure.