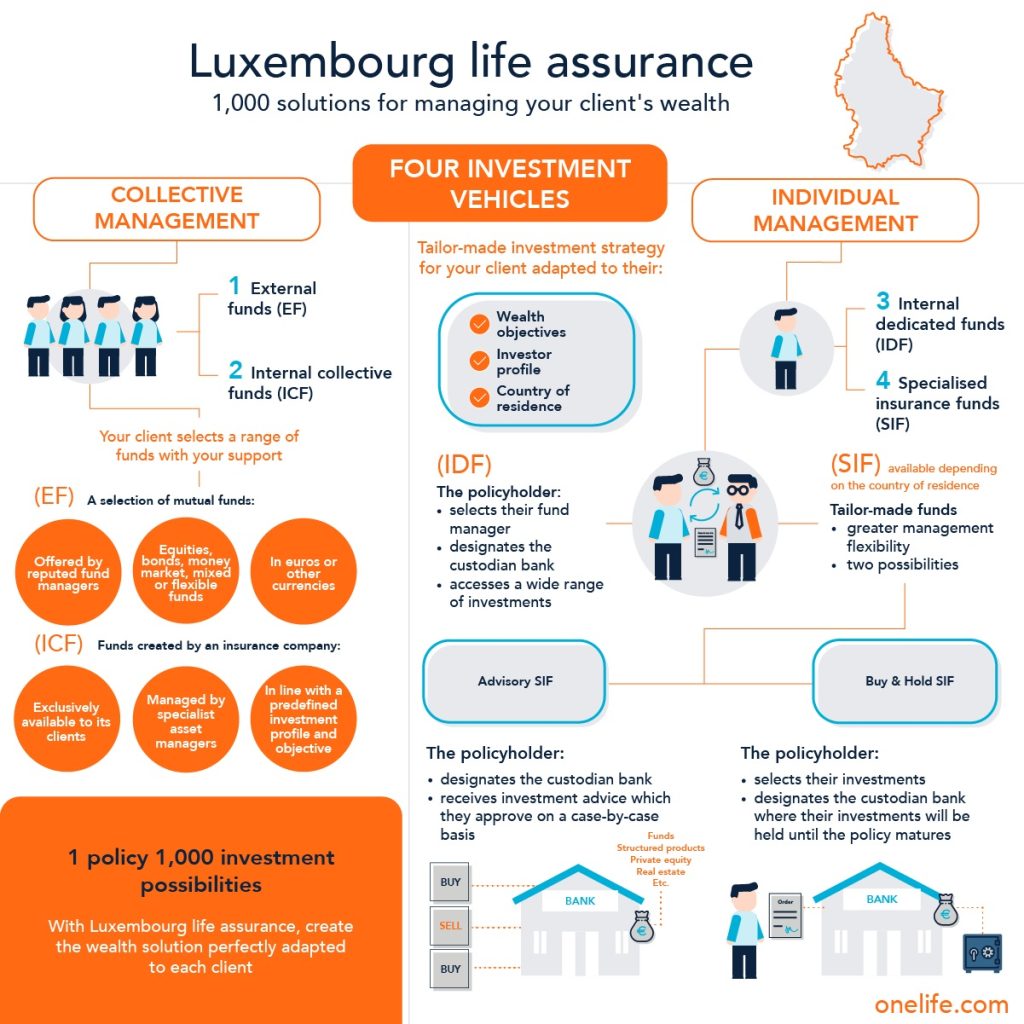

Luxembourg life insurance offers unparalleled flexibility and security in terms of investments. At the heart of this architecture are four vehicles adapted to the different forms of investment: external funds (EF), internal collective funds (CIF), internal dedicated funds (IDF) and specialised insurance funds (SIF).

Choosing Luxembourg life insurance means that clients benefit from a tailor-made investment strategy based on:

- Their wealth objectives

- Their investor profile

- Their current and future country of residence

The different vehicles for investing in life insurance

Four vehicles are available to house investments within the life insurance policy:

- Collective investment vehicles:

- External funds (EF): insurer selection of mutual investment funds offered by reputable international fund managers. Find out more.

- Internal collective funds (ICF): funds tailor made by an insurer in collaboration with well-known asset managers according to specific objectives. ICFs are specific to an insurer and are reserved for its clients. Find out more.

- Individually-managed vehicles

- Internal dedicated funds (IDF): investment funds tailor-made for the client, managed by the investment manager of their choice, with assets held in the custodian bank that they have appointed. Find out more.

- Specialised insurance funds (SIF): tailor-made investment funds with two management options: either to allow the client to manage their investments with the help of an advisor, or to invest in one go and keep the investments until maturity, without the intervention of a manager. Find out more.

Access to these different vehicles depends on the net transferable wealth, the amount invested in the life insurance policy and the policyholder’s country of residence. It is possible to combine several vehicles within the same policy according to the objectives.

Collectively-managed funds

External funds (EF)

The insurer offers a selection of mutual funds marketed and managed by internationally renowned managers. The client makes their choice with the help of their advisor based on their objectives and risk profile.

The client has the choice between equity, bonds, money market, mixed, sector-based, flexible funds, etc., denominated in euros or in other currencies.

Internal collective funds (ICF)

These are tailor-made funds designed by the insurer in collaboration with reputable managers and are reserved for the company’s clients in order to meet their different wealth objectives and investment profiles.

They allow a higher degree of personalisation than external funds at lower transferable wealth and investment requirements than individually managed funds.

Automatic switching

Collective investment vehicles offer an automatic switch option that can be activated or deactivated at any time.

The automatic switch option makes it possible to activate automatic fund purchases and sales within the vehicle in order to:

- Secure capital gains

- Minimise losses

Individually-managed funds

Internal dedicated funds (IDFs)

The client’s assets, which are held by the custodian bank of their choice, are entrusted to their appointed manager, who offers a personalised management based on the client’s objectives and investor profile.

This approach allows for a tailor-made investment strategy. It also offers access to a much wider range of assets, depending, however, on the client’s transferable wealth and the amount invested in the policy.

For families: the Umbrella IDF

Members of the same family may jointly hold an IDF for their respective life insurance policies, provided that they have the same investment strategy.

Specialised insurance funds (SIFs)

N.B. the availability of this vehicle depends on the policyholder’s country of residence.

With this vehicle, the policyholder has increased management freedom. The assets are entrusted to the custodian bank of their choice, with two management options:

- The “advisory” SIF: the client chooses their investment adviser. The latter sends them buy and sell proposals which they validate on a case-by-case basis. As such, the client remains an active player in the management of their assets.

- The “Buy and Hold” SIF: the client selects the assets held in the policy and entrusts them to the custodian bank of their choice until the expiry of the policy. This approach provides access to a broad investment universe including real estate funds, private equity etc. (in compliance with the legislation).