Keeping the customer experience at the forefront of its concerns, the company has launched several initiatives in recent years to improve its services and meet the evolving needs of its partners and customers. And there are many projects still to come! Firmly geared towards digitalisation, OneLife is seeking to make new technologies available to all of its partners and customers, while offering qualitative, human-based exchanges.

With 40 employees, OneLife’s Customer Service handles 22,000 phone calls, 30,000 transactions and 40,000 emails every year.

Offering a multi-channel customer relationship

In the digital era, OneLife seeks to offer communication channels that are tailored to everyone: technophobes, social media addicts, loyal customers, volatile and independent customers who prefer total autonomy, customers looking for support… A customer relationship with potentially many different touchpoints!

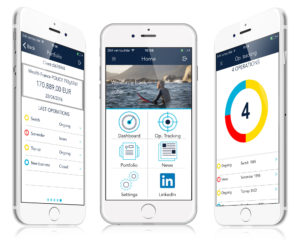

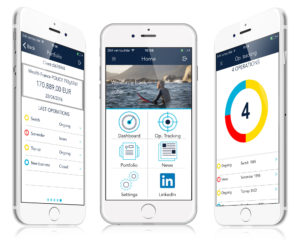

Letters, emails and phone calls are currently the most common communication channels. However, at the same time, our secure websites (youroffice for our partners and yourassets for customers), as well as our OneLife OneApp mobile application, already give our customers the ability to stay connected with us 24/7. These digital channels enable them to obtain information about our services, products, market and company news, as well as to perform certain transactions and consult their portfolios or the status of pending transactions.

=> Download “OneLife OneApp”!

Available on Google Store or Apple Store.

In the future, OneLife will offer even more opportunities by providing online (paperless) documents, and gradually implementing electronic and online signatures. With these new tools, the company is aiming to support its partners for whom the administrative complexity of particular files, partly caused by increasing regulations (MiFID, CRS, PRIIPS, etc.), can hinder the implementation of our solutions.

We are also considering implementing a conversational agent to enable all our partners and customers to very quickly obtain the information they need on specific issues relating to new regulations, our administrative practices or our online process, at any time and without even having to pick up the phone.

=> Are you a OneLife partner?

Consult your clients’ portfolios in real time 24/7 thanks to our secured online portal your office!

=> Click on the icon below.

Automating volume processing in order to dedicate time to human aspects

Our Customer Service employees spend a great deal of time interacting with the various IT applications. To achieve their mission, they very often have to perform various re-entries or copy-paste data from one window to another, or have to compare and verify information from multiple applications. This can cause errors and prevent them from dedicating time to their key objectives, such as providing support to our partners and customers, or undergoing ongoing training to increase the skillset of each employee and so provide a better service.

“In a few years, many volume-based processes will be automated. Serving as a single point of contact for our partners and customers, we will be able to devote more time to our relationship with them, to providing support and follow-up on files, especially for complex cases which are becoming increasingly common. In this context, our added value lies in our knowledge and our know-how.” Thomas Sainz, Customer Services Department Manager.

Therefore, OneLife has recently begun using robotic automation for certain repetitive volume-based tasks which have little added value. This initiative involves developing and implementing “software robots” to perform the process between the various systems, instead of employees, in order to save time and free up employees to focus on key transactions for our partners and customers.

= > Are you a OneLife customer?

Find out the various features of our secure portal ‘yourassets’!

=> Click on the icon below.

Continuous training of our employees

The life insurance sector is very broad. To deliver a quality service, our employees not only have to stay abreast of the latest regulations in Luxembourg, but also those at European level and in all markets where we operate.

Moreover, these activities require technical and financial knowledge that must be kept constantly up to date.

“Constant changes in regulation on a national, European and international basis, combined with the increasingly sophisticated needs of wealthy clients who are becoming more mobile, require real expertise from cross-border life assurance specialists such as OneLife.

The knowledge and understanding of our teams as well as a truly pragmatic approach to digital are the key elements of a successful all-round client experience, based on the two priorities which we value most – quality and trust.” Eric Lippert, Chief Operations Officer.

To achieve this, OneLife regularly organises trainings to ensure that its employees’ knowledge is as complete and up-to-date as possible.

Contact our Customer Services

- For all new transaction requests (new contracts, additional payment, arbitration, redemption, etc.) and any administrative changes to a contract (change of beneficiary, address, etc.), click => here;

- For all questions and information requests, click => here.