Brussels. 18 October. 11th edition of OneLife’s International Investment Forum.

The Investment Forum is OneLife’s annual event, providing a forum for networking, exchange and debate on the main topics and trends affecting life assurance across Europe. In the morning, workshops on cross-border solutions and non-traditional assets; in the afternoon, a focus on traditional Investments led by our fund house partners. And all on the theme of Crossing borders for clients and investments!

This year’s Forum welcomed over 500 participants to the Brussels Kart Expo, with close to 50 exhibiting investment houses (both traditional and non-traditional players), an array of speakers from across the industry as well as OneLife’s own teams of experts … Visitors interacted digitally as well as face to face with the aid of the Poken device, allowing the exchange of contact details, download of fund documentation and voting on the quality of the workshops and conferences, all through a simple touch of the Poken!

About the OneLife Investment Forum

Antonio Corpas, CEO OneLife, gives his view on the Forum: “The Forum, now in its 11th year, owes its success to being ‘open’. Open to exchange, open to what’s affecting our industry, open to change. How we adapt and work with our partners in an evolving world is key …”. The Forum was created for its Belgian partners, a market where OneLife leads, and in the past 2 years has been extended to international markets in line with the company’s growth strategy resulting in participants from over 10 countries in attendance! The Forum provides the opportunity for an entire day of meeting, networking and exchange on the important issues facing the financial services sector and insurance today. With OneLife’s distribution partners on the one hand and our investment partners on the other, we consider: What are the changes affecting our industry? How do we confront them? What are the opportunities they offer?

Cross-border wealth planning

Following an opening address by Antonio Corpas, OneLife CEO, the Forum kicked off with a number of morning workshops presenting the benefits of using Luxembourg life assurance as a cross-border wealth planning solution. With its flexibility, high levels of investor protection and portability across borders, a life assurance policy is an effective way to protect, preserve and transfer wealth through the generations. With the increasing mobility of HNWIs and their families, the complexity of international tax and the diversity of assets available, finding the right wealth planning solution isn’t always easy. OneLife’s experts, hand in hand with speakers from international legal firms, asset managers and non-traditional assets specialists, covered a variety of subjects ranging from the opportunity provided by real estate investments, wealth planning solutions with special focus on UK-Spain and France-Belgium-Portugal and the pan-European marketplace for debt.

Traditional Investments

In the afternoon, over 40 fund houses had the opportunity to present their fund strategies, asset allocation models, performance and points of innovation across many industry sectors to Forum participants. With active debate and exchange as an integral part of the workshops, understanding the diversity and opportunity offered by investment funds is key to success in managing client portfolios. OneLife’s approach of gathering the top international fund houses for an afternoon of thought leadership provides investors with a unique perspective into the world of investment and its latest trends and techniques. External funds can be held as underlying investments in life assurance policies, investments which help to preserve and grow wealth over the long-term.

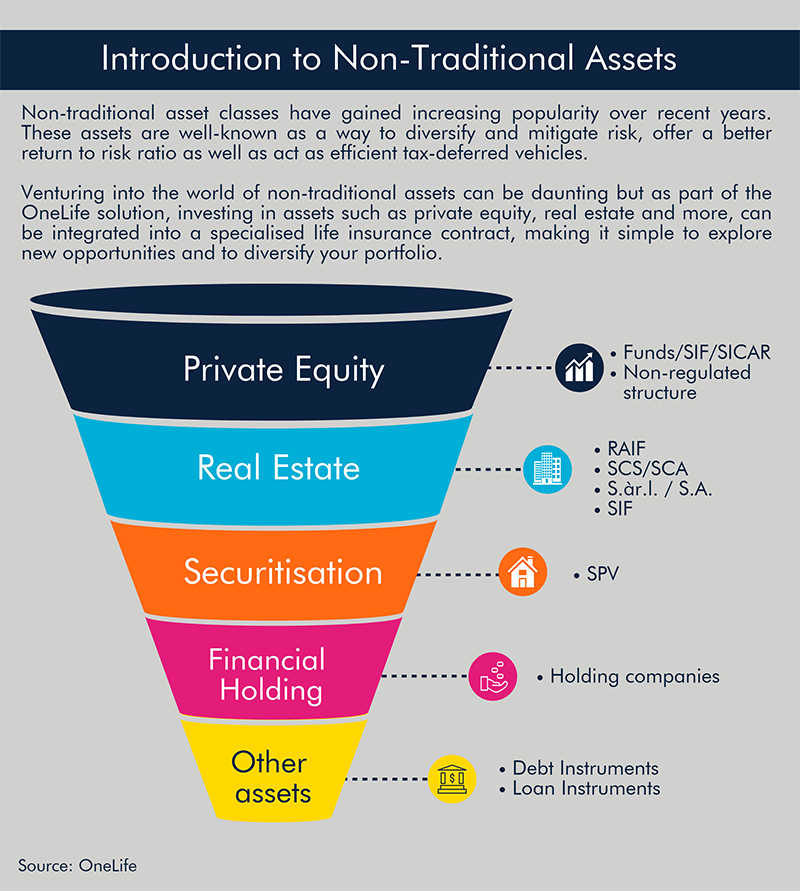

Non-Traditional Investments

This year, OneLife invited 8 non-traditional asset managers to attend the Forum. It was the opportunity to present the increasing appeal of non-traditional asset classes such as Private Equity, Real Estate investments, Financial Holdings and Securitisation. Investing in just non-traditional investments or combining them with more traditional ones like Equities, Bonds, Money Markets and Unquoted Assets can help give higher levels of return to portfolios and opens up a wide range of new asset class opportunities to the investor. Investing in non-traditional assets is possible using a Luxembourg life assurance policy. OneLife’s own dedicated team of non-traditional experts are market leaders and can help throughout the entire process of onboarding this asset type into an insurance policy. Find out more! => #Success in #Investments.

Towards the future of distribution …

The OneLife debate focussed this year on The Future of Distribution – the challenges and opportunities facing the financial services industry as it shapes up to increasing regulation, the digital (r)evolution and the emergence of new players from new industries like FinTech.

What do these changes mean for the business and servicing model going forward and what are the keys to success in this environment?

Moderated by Antonio Corpas, CEO OneLife, three speakers debated the future of distribution bringing insight from their own unique perspectives:

- Neil Browning, Executive Director – Saxo Bank

Neil is in charge of relationship management and digital sales for EMEA at Saxo Bank. With 20 years in the finance industry, Saxo Bank is one of the first financial institutions to develop an online trading platform providing ordinary investors with the same tools and market access as professionals.

- Jean-François Chatelain, Founding Partner – Family Partners

Jean-François is the co-founder of Family Partners, a French multi-family office created in 2011 and dedicated to the support of wealth families. He has extensive experience with UHNWI on the international scene.

- Marc Gouden, Partner – Philippe & Partners

Marc has been with Partner at Philippe & Partners law firm since 2005 in charge of providing legal advice, assistance in contract negotiation as well as litigation services in international business law and has a special focus on the insurance sector.

On the subject of regulation, despite the burden it brings, opportunity is never far behind. Marc Gouden for example sees increased professionalism resulting from more regulation coupled with less litigation due to better informed files and express investor consent.The views of our speakers on the impact of the digital transformation were mixed with Saxo Bank’s technologically sophisticated trading platform offering new services to investors. Whilst in the Family Office world, the reliance on paper-based documentation and services is still the norm.

Speakers agreed that new FinTech players have the potential to bring new services to the wealth management industry and that a balance of traditional and non-traditional solutions would create valuable partnerships for both clients and intermediaries alike.

Thanks to all participants who came to this year’s OneLife International Investment Forum – and we look forward to next year!

Experience the OneLife International Investment Forum first-hand: watch => our video and see the => pictures!

Want to know more about Investments? Download our #Success in #Investments => e-book and => Checklist. And find out how Non-Traditional Assets (NTA) can help you make the most of your investments!