In light of families’ unquestioned propensity for greater mobility, the settlement of successions has become more complex with so many cases now incorporating an international element. The place of residence of the deceased and heirs and the location of the assets may give rise to double taxation at the time of succession. It is therefore important to stress that international estate planning must cover both the civil and fiscal dimension.

Despite its international expertise and products adapted to such mobility, Luxembourg does not constitute an exception, and estate planning through life assurance products must also be conducted with caution if double taxation is to be avoided on settlement of the contract. Located between Belgium and France, insurance companies in Luxembourg deal with numerous cases involving both of these jurisdictions.

In order to fully grasp the difficulties that may arise out of Franco-Belgian estate planning, we must first outline the general guiding principles followed by a brief description of the rules of succession applicable in each country, to ultimately conclude to any possible reconciliation between these principles in order to create an effective estate management framework.

I. Harmonisation at the civil level without fiscal impact

The EU Regulation of 4 July 2012 harmonises the rules covering competence, applicable law, acknowledgement and implementation of decisions and acceptance and execution of authentic instruments covering succession.[1] It applies to successions opened from 17 August 2015 and covers all aspects of civil law, yet specifically excluding tax, customs and administrative matters.[2]

It is therefore entirely possible that, within an international context, the applicable civil law may differ from the pertinent tax law. Property vested under the law of one country may therefore be taxable in another. As the tax treatment of life assurance contracts differs from one country to another, it is pertinent at this stage to focus on the specific regimes applicable in France and Belgium.

II. French tax regime applicable to life assurance contracts

a. General principles

In principle, amounts paid on the death of the life assured to a given beneficiary do not form part of the estate and are therefore excluded from the calculation of the reserved and disposable portion of the succession.[3] Yet there are a number of exceptions, notably should the premium be considered as “manifestement exagérée” which is established on a case-by-case basis, including in light of the policyholder’s age, family situation, wealth and suitability of the contract.

Furthermore, in the event of no beneficiary being designated, of refusal on the part of the beneficiary, or where the beneficiary dies before the life assured, the amounts paid out by the insurer on settlement of the contract are reincorporated within the estate of the life assured and will be subject to death duties in the same way as the rest of the deceased’s estate.[4]

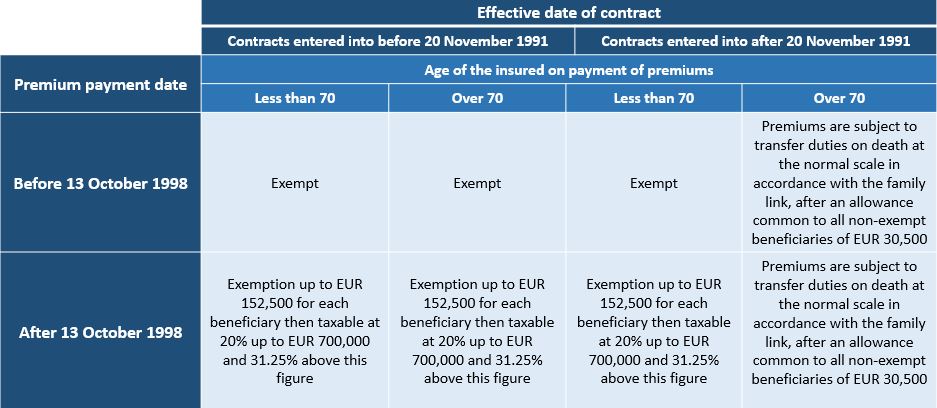

French legislation distinguishes between different types of life assurance contracts in order to apply specific tax treatment on the death of the life assured. Such treatment will notably depend on the date the contract was entered into and the age of the life assured at the time premiums were paid. Accordingly, after specific allowances, the amounts will be subject to death duties (by way of exception)[5] or to specific flat tax as follows [6] :

The amounts paid by the insurer on the death of the life assured to their spouse, partner (“Pacs”), or siblings (subject to certain specific conditions) are exempt from death and other specific duties, regardless of the age of the life assured at the time the premiums were paid. For any other beneficiary of a contract taken out after 20 December 1991 for which the premiums are paid after the 70th birthday of the life assured, death duties will be applied depending on the family link between the life assured and the beneficiary (with a maximum rate of 45% for the direct line from EUR 1,805,677).[7]

Furthermore, and still within the context of a contract taken out after 20 December 1991 for which the premiums are paid after the 70th birthday of the life assured and given the application of death duties in accordance with ordinary law, the various allowances available under ordinary law[8] may be added to the overall allowance of EUR 30,500. Finally, it should be noted that capital for which social contributions were not paid during life will be subject to them at a rate of 17.2% on death.

b. When do French death duties apply?

Various criteria trigger the application of French death duties:[9]

- The fact that the deceased was French tax resident at the time of death;

- The fact that the heirs/beneficiaries were French tax residents at the time of death and had been so for a period covering at least six of the past ten years;

- The fact that the transferred asset (movable or immovable) is located in France.

Accordingly, and subject to the application of any double tax treaties, where the deceased was French tax resident at the time of death, death duties apply to their worldwide assets.[10] Furthermore, where the deceased was not French tax resident at the time of death, in the event of heirs/beneficiaries being French tax residents, death duties apply to worldwide assets[11] or, where neither the deceased nor the heirs/beneficiaries are French tax resident, only to assets located in France[12].

III. Belgian tax treatment of life assurance contracts

a. General principles

The tax implications of opening a succession on death unquestionably include the obligation for the heirs to pay the death duties calculated on the basis of the inheritance declaration previously submitted by the heirs, within 5 months of the deceased’s passing.

Determining the amount of such death duties is a competence lying with the region (Brussels-Capital, Wallonia, Flanders) in which the inheritance declaration was submitted, namely the region in which the deceased had their most recent tax residency. Further, the family link between the deceased and the beneficiaries of the succession will determine the applicable rate of death duties. Set at regional level, death duties in Belgium vary between 3% and 80%.

More specifically regarding life assurance contracts, the structure of the contract may constitute an effective remedy to the high death duties normally applicable by the opening of the succession. Regionalisation within Belgium does not make matters straightforward in this area.[13] Most noteworthy (and sometimes startling) are the positions adopted by the competent authorities in the Flemish region regarding the calculation, verification and payment (or even reimbursement) of death duties and their registration.[14]

The pertinent articles of the Inheritance Tax Code (regions of Wallonia and Brussels-Capital) and of the Flemish Tax Code (region of Flanders) signify that a “stipulation pour autrui” (provision in the contract conferring a benefit to a third party) is subject to death duties.[15] This particularly pertinent provision is an essential criterion for any estate planning activity. In practice, the applicable legal texts signify that a “stipulation pour autrui” is always present in a life assurance contract where the life assured and the beneficiary are not the same person.

An initial way of avoiding death duties by using a life assurance contract structure would be, for example, to convert a “stipulation pour autrui” into a “stipulation pour soi-même” (personal stipulation, not taxable as does not fall within the scope of application of the law), by means of assignment of rights in the contract (commonly known as “donation” of the contract). This potentially results in the application of gift taxes (3% or 3.3% for the direct line, depending on the region), thereby excluding any application of death duties.

b. When do Belgian death duties apply?

The application of death duties in Belgium can be categorised as follows:

- If the deceased was a tax resident of Belgium at the time of death, death duties are due on worldwide assets, less any debts secured against aforementioned assets.

- If the deceased was a tax resident of a foreign country at the time of death, death duties are due on the value of immovable property located in Belgium. Debts secured against such property are deductible under certain conditions. Progressive rates apply that vary by region (Brussels, Flanders, Wallonia). We will talk more specifically about transfer duties.

The essential criterion for establishing the application of Belgian death duties therefore remains the tax residency of the deceased (not only Belgium but more widely, namely the region in which the concerned Belgian tax resident resides).[16]

We therefore note that the criteria for assigning powers of taxation regarding death duties vary from one country to another. France and Belgium are no exception to this observation. It remains to be seen whether any effective fiscal reconciliation can be established between the two regimes… Such an analysis will be covered in a subsequent contribution.

If you are interested in these case studies, download our e-book #Success in #Succession Part I and Part II

Authors:

![]() Fanny PERPERE – Wealth Planner

Fanny PERPERE – Wealth Planner

![]() Nicolas MILOS – Senior Wealth Planner

Nicolas MILOS – Senior Wealth Planner

[1] REGULATION (EU) No. 650/2012 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 4 July 2012

[2] REGULATION (EU) No. 650/2012 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 4 July 2012, Article 1.1

[3] Art. L 132-12 of the Insurance Code (C.ass.)

[4] Art. L 132-11 C.ass.

[5] Art. 757 B of the General Tax Code (CGI)

[6] Art. 990 I CGI

[7] Amount applicable for 2019

[8] Art. 779 CGI and Art. 788 CGI

[9] Art. 750 ter CGI

[10] Art. 750 ter 1° CGI

[11] Art. 750 ter 3° CGI

[12] Art. 750 ter 2° CGI

[13] Law of 16 January 1989 on the financing of the communities and regions.

[14] Reference is made on this matter to a previous contribution entitled “Reforming the Belgian Civil Code: VLABEL is adapting quickly… maybe even too quickly”, N. MILOS.

[15] Article 8 of the Inheritance Tax Code; Article 2.7.0.1.6 of the Flemish Tax Code.

[16] Region of Brussels-Capital, Wallonia or Flanders. It should be noted that if the deceased was a tax resident in more than a single Belgian region during the 5 years preceding death, the applicable rates will be those of the region in which they were a tax resident for the longest period.