Rising interest rates have been a worry for investors for the last couple of years, without that fear actually manifesting itself in market movements. We have seen interest rates on the rise this year, as was to be expected from the historically low – and in many cases negative – levels. An overview.

Especially in the US, where 10-year yields moved from 2.40% at the end of 2017 to 2.86% by the end of May, with an intermediate high of 3.11%, meaning an amplitude of +0.71% at the most, we saw some volatility but the trend is clear and might not be finished either: up! The market indeed sees 3 to 4 more hikes by the Federal Reserve in short-term rates, and these clearly have their influence on the expectations surrounding long-term rates, even if part of the rise on the short-term rates is lost in a considerable flattening of the curve (i.e. a shrinking difference between short-term and long-term interests). Most investors in US debt seem to be positioned in quite short duration assets or floaters that might even profit from gradually climbing rates. Benchmarks, which traditionally tend to have quite long average duration, have suffered more than real portfolios it would seem.

It’s a different picture in core Europe: 10-year yield on the German Bund started the year at 0.43%, had an impressive climb up to 0.77% by early February, before coming back down more slowly to levels between 0.50% and 0.60%. By the end of May, mainly driven by the flight to quality over Italian political turmoil, it dropped steeply and actually ended the 5-month period we are considering here lower than it started, at 0.34%.

As they are used by quite a few portfolio managers for the sake of yield enhancement, we should of course also take into consideration the so-called “peripheral Europe” bond markets, mainly represented by Italian government bonds. The 10-year yield on those BTP’s (Buoni del Tesoro Poliennali – multi-annual treasury bonds) followed quite a different path: starting the year at just over 2%, it was actually pretty stable until mid-March, when it started declining to reach a low of 1.72% by mid-April. From the second week of May, politics took over the agenda and 10-year rates skyrocketed to 3.16%, finally ending the month of May at 2.80%.

Just to be complete: Japanese government bonds, although an enormous market in size, are only very scarcely used by our main portfolio managers, because Japanese yields are really microscopic. The 10-year rate was at 0.05% to start the year, it “shot” up to 0.10% by the end of January before falling again to 0.04% by the end of May. Not exactly an interesting asset for non-JPY investors.

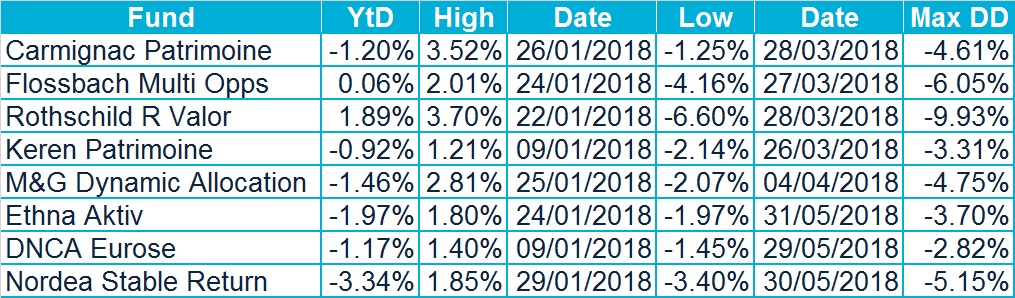

So, what then has been the influence of these interest rate fluctuations on an actual client’s portfolios ? We have looked into the top-8 of flexible funds in our external fund range to get a diversified view on what different types of allocators and flexible managers did over the first 5 months of the year.

What do these figures, and specifically the timing of Highs and Lows, teach us about the correlation with interest rates ? Well, it would look like there is an almost negative correlation between most flexible funds and Bund prices, despite their portfolios often being mainly invested in bond type assets.

The peaks by the end of January (6 out of 8 funds) coincide with the highest 10-year Bund yields observed since the beginning of the year. This is probably the result of extreme confidence in the markets, making slightly higher interest rates positioning by the Central banks more likely because they consider the economy can take it without too much trouble. Whenever this risk appetite drops, for whatever reason, we see 2 phenomena: markets thinking Central banks might go slower on rate hikes to avoid cooling off the economy, plus a “flight to quality”, i.e. investors taking money out of stocks and into safe havens like German govies. Both will drive yields down.

Portfolios however are not invested like the bond benchmarks today: we see a lot more credit risk, both on corporates and on peripheral govies than in standard government bond benchmarks. And duration looks completely different too from that on the core European government debt market, with nobody really daring to be invested far out on the curve, where a slightly wrong estimation on the direction of rates can have painful consequences.

One area where some funds mark quite some correlation is unfortunately the Italian debacle on political turmoil end of May. Some of our French investment partners had their funds quite heavily exposed to Italian spreads, resulting in portfolios dropping in the last two weeks of May. This came on top of equity markets globally losing out on the Italian nervousness as well.

As a conclusion, we might say that even for portfolios with a maximum of 50% equity exposure, performances today coincide a lot more with equity indices than with bond benchmarks. The fact that managers won’t hold long duration core European government bonds like they used to do 10 years ago on the one hand will protect from the negative impact of rising rates going forward.

On the other hand, portfolios will not benefit from the same “risk dampening” they used to show when risk assets, including credits and peripheral debts that now seem to make up an important part of non-equity pockets, will suffer from increasing risk aversion in the markets.

So far it would seem managers with the highest risk budget in terms of volatility have had better returns by actively timing their risk allocation, but one does need a strong stomach to endure much higher volatility and temporary draw-downs. The more cautious risk managers, relying more on the non-equity part of their investments might be in for a hard time to put down good returns in choppy markets, especially when short-term nervousness shakes up both parts of their allocation.

For more information on investments, please contact us.

Ruben De Roover

Ruben De Roover