Abraham Lincoln once stated that in his experience, “folks who have no vices have very few virtues.”

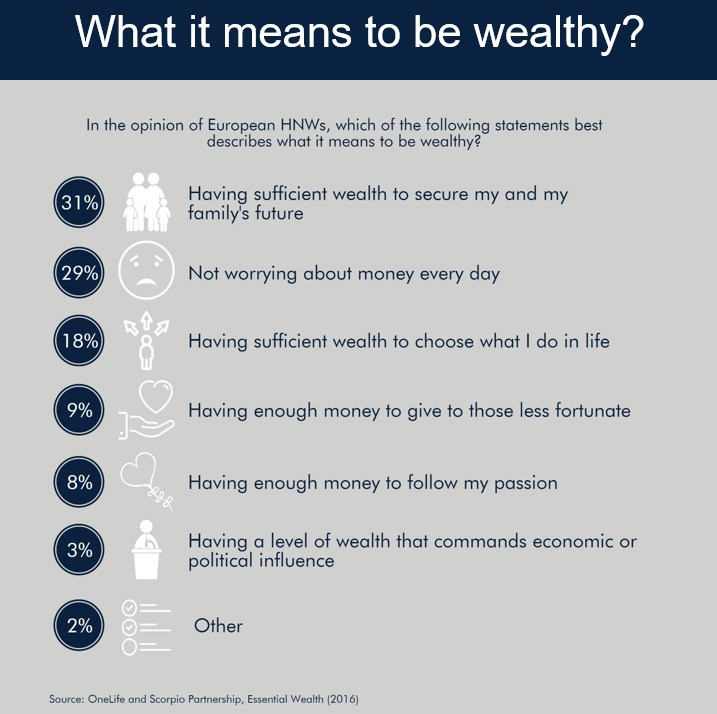

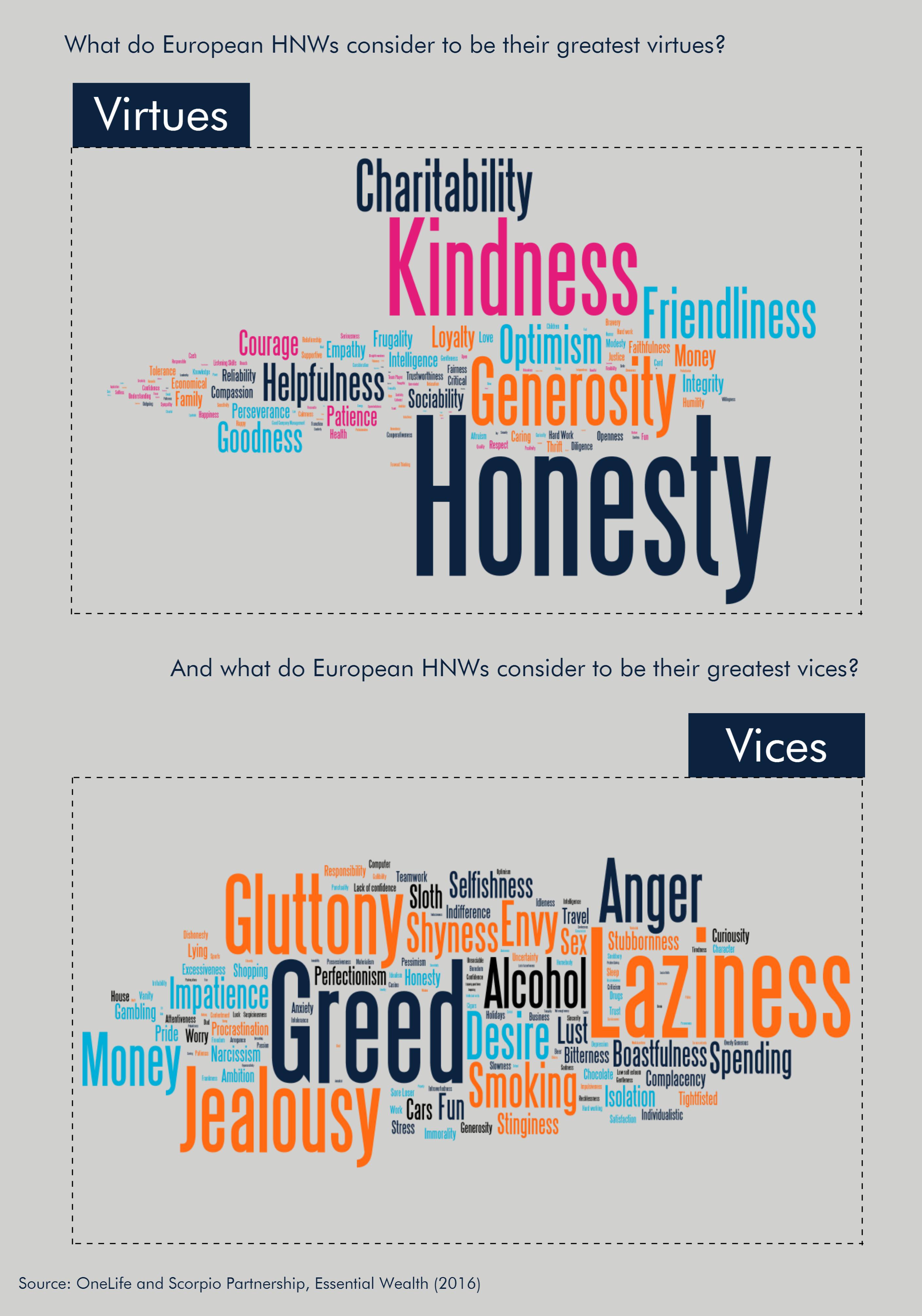

When asked what European wealth creators perceive as their worst qualities, laziness, greed and jealousy come up top.

However, they also acknowledge their foremost positive characteristics are their honesty, kindness, generosity, and their willingness to engage positively with the world around them. After a clear rise in HNWIs’ involvement in philanthropic activities post-economic crisis in 2008, providers need to start taking this aspect into consideration more seriously.

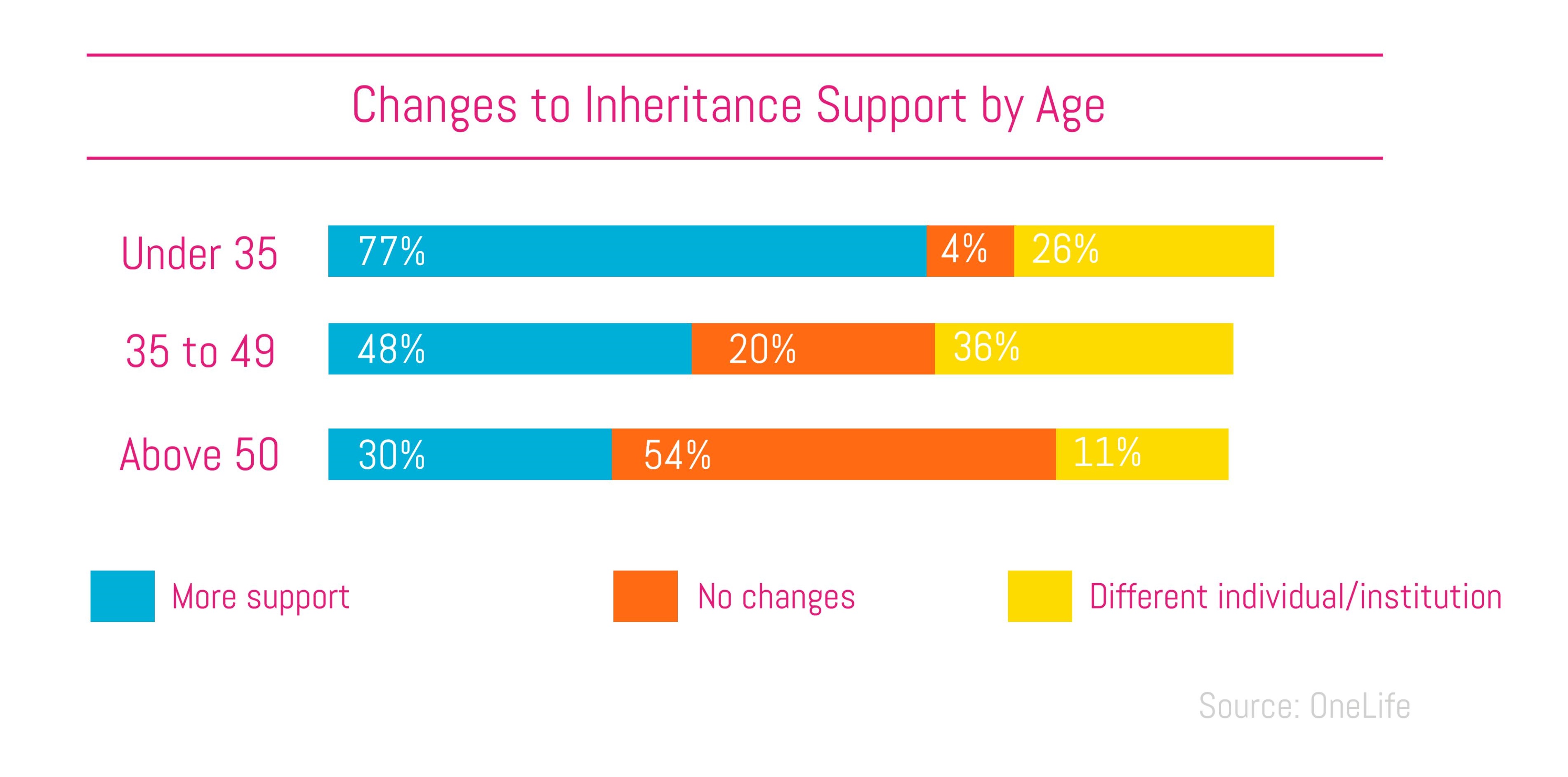

Why? Because the wealthy are increasingly willing to be the changing force in society. HNWs are interested in witnessing the ripple effect of their actions in tangible environmental, social and ethical ways. And perhaps, because they are thinking more about their futures, our research shows that millennials feel this responsibility much more strongly than the baby boomer generation.

PwC and UBS’s studies support this suggestion, additionally recommending that wealth advisors keep an open mind about investment decisions when servicing millennials. The advisors of the future will need to be able to further understand younger HNWs’ aspirations and anxieties related to giving, as well as develop an appreciation for the feelings of social responsibility this generation has placed upon itself.

Download our most recent thought leadership report ‘Essential Wealth: The Interplay between Self and Society’ to find out more!