On 20th March 2018, the French and Luxembourg governments signed a new tax treaty (the “Treaty”). This new agreement is in line with developments in the BEPS (Base Erosion and Profit Shifting) project initiated by the OECD (“Organisation for Economic Cooperation and Development”). The renegotiation and complete overhaul of the treaty concluded in 1958 (and modified by four successive amendments) marks a desire to integrate the new international tax standards and bring them into line with the new model developed by the OECD in 2017.

Luxembourg and France have begun their internal ratification procedures. This process may therefore be finalised within a matter of weeks, and the treaty should, in all likelihood, be applicable as of 1st January 2019.

- Overview of the key measures

The main objective of this double taxation Treaty is obviously the resolution of potential double taxation in cross-border situations, but not only this. The spirit of the treaty is also clearly to combat potential situations of non-taxation, such as via double exemptions. In this respect, the preamble could be used to interpret the provisions of the different articles.

In addition, and unusually, it is accompanied by a significant new protocol emphasising anti-abuse measures.

- Mechanisms to eliminate double taxation

Under the Treaty, double taxation is eliminated via tax credits, replacing the current tax exemption method.

The exemption method eliminates taxation in potential double taxation situations. For example, in the case of income earned in one State and paid to a resident of another State, the treaty will determine which of the two States is entitled to tax that income. In this situation, Luxembourg generally provides for the total exemption of that income from taxation if it is not deemed entitled to tax it under the double taxation treaty.

The tax credit method does not provide for exemptions, that is to say, for income earned in one State and paid to a resident of another State, the treaty will decide which of the two States is entitled to tax that income. The state entitled to tax the income will actually tax it. However, the other State will not lose the right to tax it. The income in question will be included in the taxable base of the person in the second State and that person receives a tax credit corresponding to the tax already paid in the first State.

This method is less advantageous than the exemption method and may lead to residual double taxation.

While the tax credit method is generally recognised under French law, this method is less common in Luxembourg, which is more likely to apply the exemption method.

The new method provided for under the Treaty may have implications at different levels, such as for French cross-border workers, residents receiving dividends that are not eligible for the parent-subsidiary scheme under domestic law (e.g. dividends distributed by a UCI (Undertaking for Collective Investment) to a Soparfi (holding company)), or for French residents earning director’s fees in Luxembourg.

2. Definition of residence and access to the Treaty

Until now, the concept of residence for legal persons has been based mainly on the concepts of “actual centre of management” and “registered office”.

In order to benefit from the provisions of the Treaty, you must be effectively taxable. Tax exemption or a very low tax rate may justify refusal of the status of resident within the meaning of the Treaty. From this point of view, not surprisingly, this merely reflects the modern interpretations of the concept of residence as well as the recent jurisprudence of the French Council of State.

However, paragraph 2 of the Treaty’s protocol gives UCIs (“Undertakings for Collective Investment”) established in one of the Contracting States that are similar to UCIs in the other State (on the basis of the latter’s domestic laws) access to the benefits of the provisions on dividends and interest for the rights held by residents of one of the two States or of any jurisdiction that has signed an administrative assistance agreement to combat fraud and tax evasion

3. Anti-abuse measures

This new treaty is worded in such a way that it communicates a clear desire to limit any misuse of its provisions. Thus, along with the notion of abuse of rights provided for in each of the States’ domestic laws, this new agreement recognises treaty abuse and allows the contracting States to deny access to the treaty for structures created principally for the purpose of benefiting from the treaty.

Through the insertion of this Principal Purpose Test (“PPT”) rule, the need for economic justification of the creation of cross-border structures is strengthened.

4. Definition of a permanent establishment

Here again, the Treaty extends the concept of permanent establishment, providing that a dependent agent acting on behalf of an enterprise situated in the other State, even without the power of signature, may constitute a permanent establishment if it is recognised that this agent played the main role leading to the conclusion of the contract. This role should be limited to preparatory and auxiliary activities. This new provision is of great importance for banks and insurance companies acting under the freedom to provide services.

5. Wealth tax

Under the new OECD model, immovable property forming part of a resident’s fortune will be taxable in the State where the asset is located.

On the combined reading of Articles 6 and 21, the Treaty could allow for the exoneration of a Luxembourg resident holding property in France through a company from the IFI (“Impôt sur la Fortune Immobilière” or real estate wealth tax).

6. Treatment of capital gains on disposals

Capital gains from the disposal of equity-related securities remain unchanged from the 2014 amendment, and are taxable in the State where the asset is located. What is new in the Treaty is that property dominance will now be analysed over the 365 days preceding the disposal.

Another important point: capital gains arising from a sale by a natural person directly or indirectly holding more than 25% of the capital of a company resident in one of the Contracting States may be taxed in that State if the seller has been a resident of that State at any time during the five years preceding the sale. It will be interesting to see how this provision of the Treaty articulates with the modifications to the French exit tax to be adopted under the budget bill for 2019.

7. Expansion of the concept of “dividend”

On the basis of the Treaty, the notion of dividend extends to everything that falls under the dividend tax regime in the distributing company’s State of residence. Consequently, income deemed to be distributed and other liquidation proceeds will fall entirely within the scope of the concept of dividends provided for in the Treaty.

The 15% withholding tax provided for in Article 10 remains similar to that provided for under the old treaty. The Treaty also grants an exemption from withholding tax on dividends paid by resident companies holding at least 5% of the capital of the company owing the payment over a period of 365 days.

What’s new relates to dividends distributed by certain property investment vehicles such as REITs (“Real Estate Investment Trusts”) or UCITS (“Undertakings for Collective Investment in Transferable Securities”), which will be subject to higher withholding taxes. Thus, a 15% withholding tax will be payable on dividends paid by such vehicles when the beneficial owner directly or indirectly holds a stake of less than 10% of the capital and 30% when the holding exceeds this threshold.

8. Interest

Interest income will no longer be subject to withholding tax; the previous treaty provided for a withholding tax limited to 10%. It should be noted, however, that the Treaty expressly excludes excess interest (that does not comply with the arm’s length principle) from this scheme.

- The interest of the new treaty with regard to cross-border life insurance

Based on the above developments, it is interesting to note that the new treaty is generally more restrictive and less beneficial to residents of both States.

The Treaty could have a major impact on some asset structuring. Certainly, while the State where the property is located is entitled to tax it, the State of residence will still retain its taxation right and double taxation will be eliminated thanks to a tax credit in France.

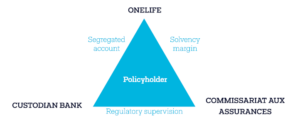

However, this new agreement does not deal with cross-border life insurance plans and is even beneficial for French policyholders who have invested wisely in life insurance policies such as those offered by OneLife.

They will be able to take advantage of the group effect (due to the very large number of policyholders investing via OneLife) on taxation at source of insurance policy income, via:

- the integration of a plan similar to the parent-subsidiary plan at the level of the Treaty that allows for the total exemption of dividends paid on life insurance policies from withholding tax;

- the maintenance of the reduced withholding tax rate for ordinary dividends that cannot benefit from the aforementioned parent-subsidiary plan;

- the elimination of withholding tax on interest paid on life insurance policies.

These provisions further increase the attractiveness of Luxembourg life insurance compared to other asset structuring mechanisms, particularly, but not only, with regard to immovable property.

And finally, life insurance has an additional advantage in terms of anti-abuse provisions because it is also an element of wealth transfer with an attractive tax regime.

Please note that the above developments are merely an overview of some of the provisions of the new Franco-Luxembourg treaty and that the practical impact of these measures will have to be evaluated on a case-by-case basis. OneLife’s experts are available if you have any questions.

Authors:

Fanny PERPERE – Wealth Planner

Fanny PERPERE – Wealth Planner

Jean-Nicolas GRANDHAYE – Corporate Counsel

Jean-Nicolas GRANDHAYE – Corporate Counsel

Professional secrecy is based on the same principle as medical secrecy, where the patient discloses confidential information to his/her confidant in complete trust. Similarly, customers have to reveal confidential financial information to their confident, be it their banker or insurer.

Professional secrecy is based on the same principle as medical secrecy, where the patient discloses confidential information to his/her confidant in complete trust. Similarly, customers have to reveal confidential financial information to their confident, be it their banker or insurer.