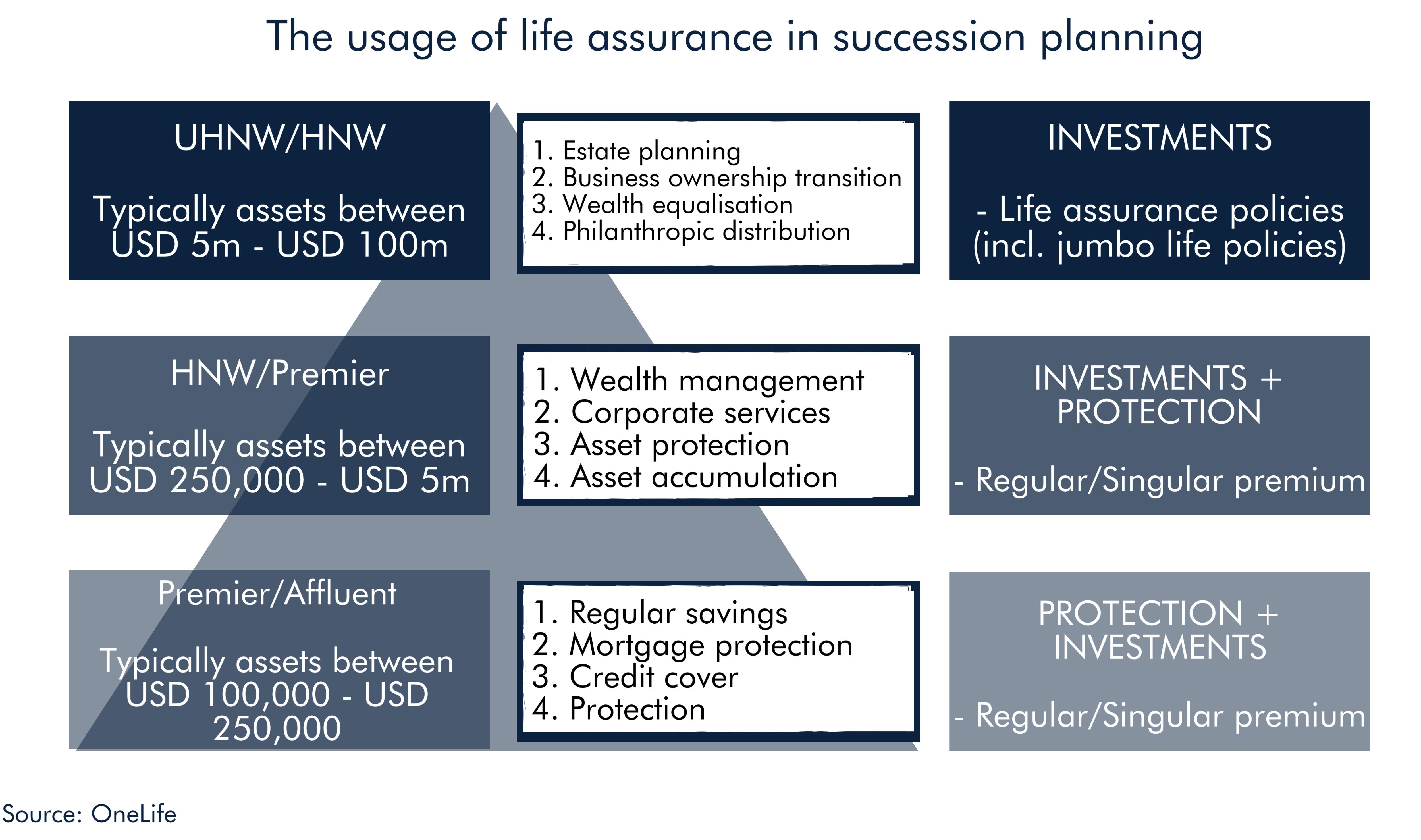

As well as the protection that life assurance offers, the solution is advantageous as a tool for succession planning on the UHNW/HNW level. Life assurance provides tax efficiency while safeguarding assets in a portfolio. This is of paramount importance to the ultra-wealthy who could have their legacy drastically impacted by inheritance tax.

The following infographic shows the three basic types of solutions on the far right and the central column lists the roles which life assurance typically play in each type of solution.

Interested in learning more?

Click through to our SlideShare for more information on the ways in which life assurance can be used as a wealth transfer mechanism.