At our 10th Investment Forum in Brussels this month, intermediaries from around Europe had the opportunity to meet fund house representatives and OneLife team members during a day of discussions ranging from cross-border relocation to the role of non-traditional assets in life products.

The 10th edition of the OneLife Investment Forum at the Brussels Kart exhibition centre in Belgium on 19 October gave our intermediaries the opportunity to meet and discuss with representatives of many leading fund houses as well as our OneLife teams.

Cross-border and investment were the key themes of the forum, at which 43 fund houses were represented, including both long-term OneLife partners and new additions to the community.

OneLife CEO Marc Stevens opened the forum by introducing Pepper, a humanoid robot who interacted with visitors throughout the day through an iPad on its chest, providing information on OneLife and posing for selfies.

Participants chose among 38 sessions organised by OneLife and the fund houses in English, French and Flemish, on topics ranging from investing in a low-interest environment to exploiting risk premiums and combining alpha generation with lower volatility.

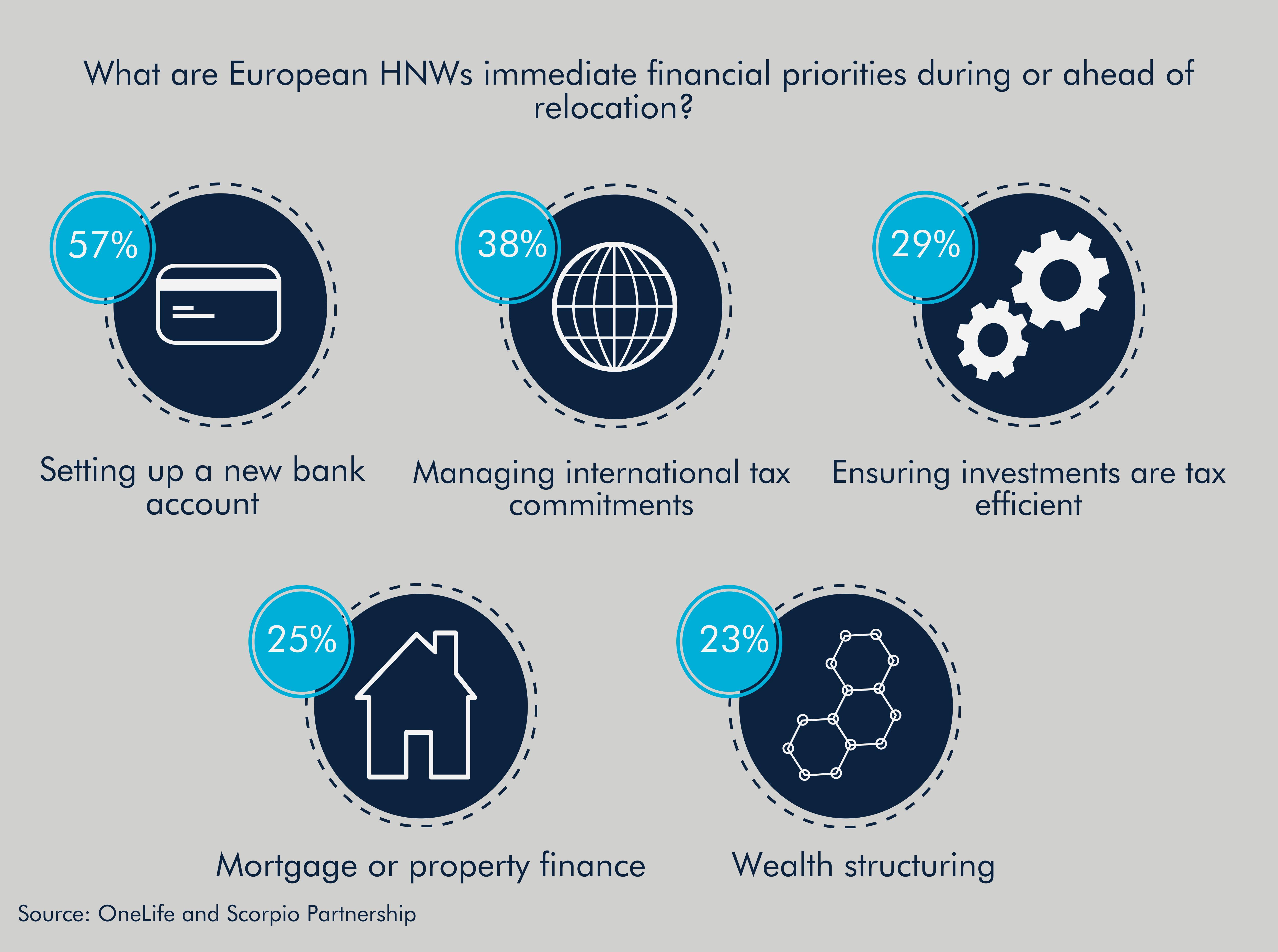

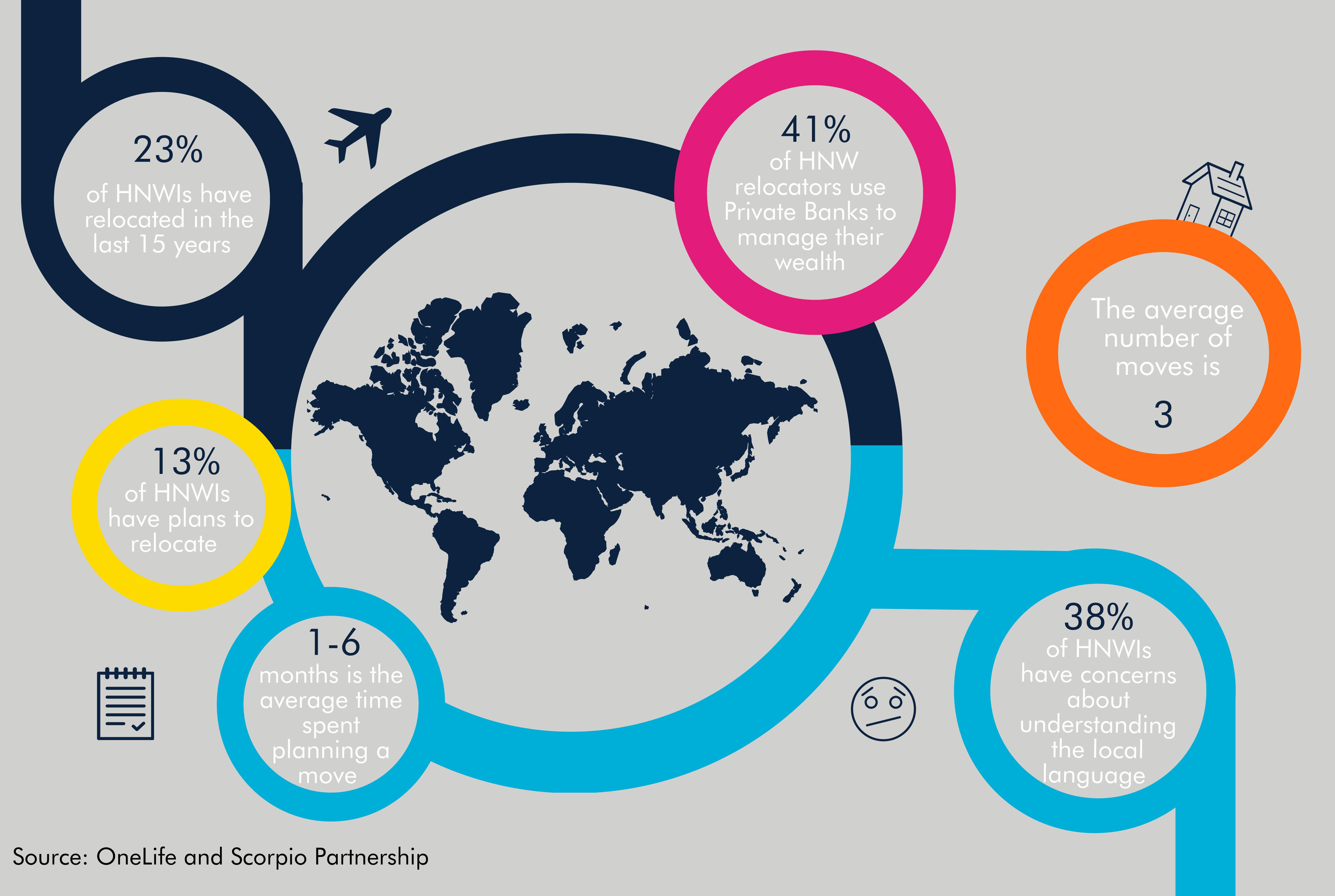

In the morning, the focus was relocation. OneLife wealth structuring team members presented portability case studies involving moving from Sweden to Portugal, from the UK to Spain, France to Portugal and Belgium to France. They were supported by external experts from Carnegie Private Banking, Uria Menendez, Baker McKenzie, Cuatrecasas, Arkwood and RPBA.

In the afternoon, OneLife investment relationship manager Ruben De Roover moderated the main conference, leading an interactive debate on flexible management involving DNCA Investments, Ethenea, J.P Morgan Asset Management, M&G, Investments and La Financière de l’Echiquier.

Non-traditional assets were also on the agenda. OneLife director of non-traditional assets Anthony Lorrain and financial assets analyst Liana Aghabekyan conducted a panel presentation providing insight into current topics such as: why Luxembourg life insurance is particularly suitable for non-listed assets; how non-traditional assets can be integrated into life insurance contracts; and risks relating to unlisted assets in regulated and non-regulated environments.

The formal proceedings were concluded by a lively debate on vital geopolitical and macroeconomic issues between two keynote speakers, leading economists Etienne de Callataÿ and Charles Gave.

OneLife demonstrated its prowess as a digital pioneer by enabling all visitors to benefit from Poken, a cloud-based event management platform that uses a device and touchpoints to exchange contact details, collect documents and provide live feedback on the event.

After a day of learning and networking, visitors enjoyed a dinner, a giant anniversary cake and musical entertainment to close this successful event.

Enjoy photos from the event => here – and save the date now for the next edition: 18 October 2018.

Article by Vinciane Derulle

Article by Vinciane Derulle