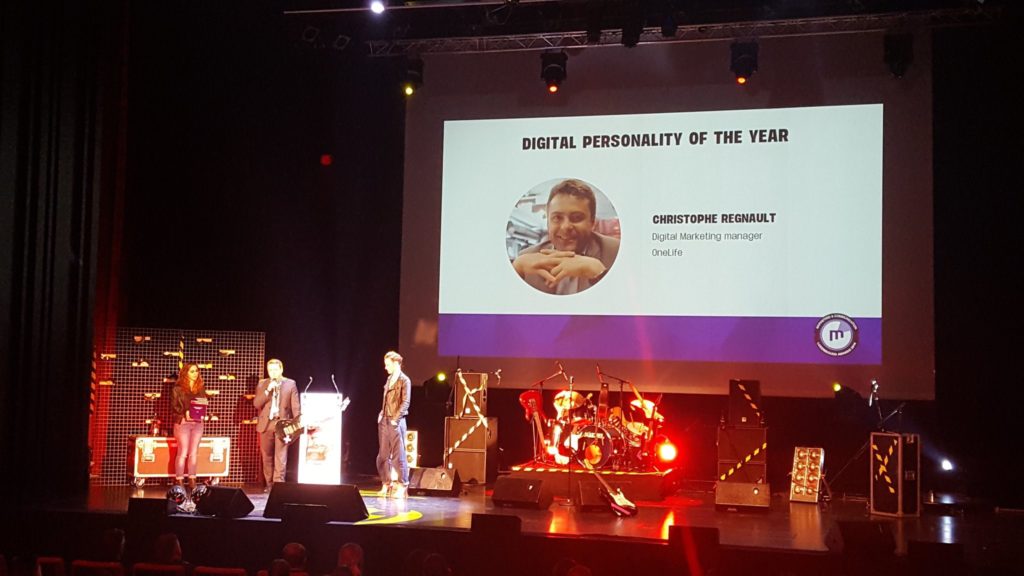

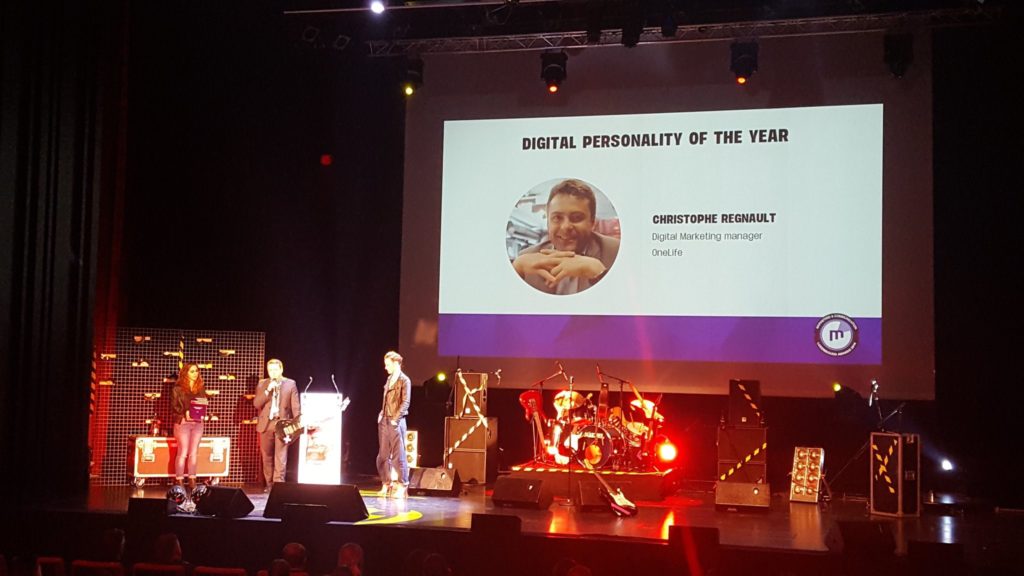

For the first time in eight years, the Gala Marketers committee has named a Digital Personality of the Year. Christophe Regnault, Digital Marketing Manager of the OneLife Company was presented with the honour on 24 November.

Christophe Regnault, Digital Marketing Manager, accepts the award. © Lorène Paquier

He met the challenge of launching a digital dynamic and successfully building a three-step action plan entirely around the HUMAN: holding workshops for teams to explain the impact of digital, creating a user-oriented digital ecosystem (internal and external) with interesting and relevant content, and the last step, developing a mobile app.

Step 1:

The first major step was leading some 24 workshops to raise awareness so all employees readily understood digital and how the process could change both their careers and homes lives, all without forgetting to have a little bit of fun in their work! This greatly contributed to the success of the project. The end result was OneLife’s highest SSI (Social Selling Index) industry ranking on LinkedIn.

Grateful thanks are due to everyone who created new profiles, who faithfully updated them and to all employees who shared them.

Step 2:

The second major step involved our rebranding. We took the opportunity to turn this project into a platform to introduce and integrate all the tools our teams needed to start moving forward. Our partners played a critical role, especially since we kicked off everything at once: a CRM system linked to a campaigning dynamic (with the Néréa Company (link)), a new website (with the e-Proseed Company(link)), with all the content, SEO (with the Vanksen agency(link)), social networks and more … all with a new image and feel that allowed us to integrate a much more digital approach.

Step 3:

The third big push in the plan was officially launching our mobile app at the InsurTech Summit (link) in October.

Once again OneLife worked in a very agile mode, that is to say, with three people internally in ongoing contact with our partner (Ainos (link) ) to deliver a mobile app in less than three months … then we spent a lot of time involving our colleagues who to helped refine the tool with all the teams. This way, everyone could test the app and make comments. The Customer Services team was heavily invested and even changed its operating procedures to incorporate the added value sought for our brokers. And that’s only the beginning … because as I have said, we have other ideas for the next versions and our colleagues have given us so many more.

In the end, the desired dynamic has been achieved, that is to say, a real substantive change that went so far as to even change our teams’ ways of working, another form of added value. Through these measures and our teams’ hard work, we (digitally) transformed testing.

Read more:

“LUXEMBOURG MARKETING & COMMUNICATION AWARDS: MEET THE WINNERS” >>> Here.

C. REGNAULT: “BUILDING MOMENTUM AND DYNAMICS IN DIGITAL” >>> Here.